Anti-money laundering refers to the set of laws, regulations, and procedures aimed at preventing criminals from concealing illegally obtained funds or assets. AML measures help to identify, track, and report suspicious financial activities. Money laundering is the process of making illegitimate funds appear legal by obscuring their origins. Criminals use various methods, such as shell companies, smurfing, and layering, to achieve this. AML efforts are critical in fighting organized crime, corruption, terrorism financing, and other illegal activities. By disrupting the flow of illicit funds, AML helps maintain the integrity of financial systems and promotes economic stability. Money laundering has been a part of human history for centuries, with early examples dating back to the Roman Empire. However, it gained prominence during Prohibition in the United States when organized crime groups needed to legitimize their illicit profits. AML regulations and initiatives evolved over time, beginning with the Bank Secrecy Act of 1970 in the United States. The 1980s and 1990s saw the emergence of global AML efforts, including the establishment of the Financial Action Task Force (FATF). Several events have shaped the AML landscape, such as the 9/11 terrorist attacks, which led to the USA PATRIOT Act and increased focus on combating terrorism financing. High-profile scandals like the Panama Papers have also underscored the need for robust AML measures. KYC policies require financial institutions to verify the identity of their customers and assess their risk profile. This helps prevent money laundering, terrorism financing, and other financial crimes. Transaction monitoring involves detecting suspicious financial activities and reporting them to relevant authorities. Financial institutions must implement robust systems to identify and report potentially illicit transactions. Risk assessment and management involve identifying, evaluating, and mitigating money laundering risks. Financial institutions must develop comprehensive AML risk management strategies to address potential vulnerabilities. Training and awareness programs ensure employees understand AML regulations, recognize red flags and report suspicious activities. These programs are crucial in maintaining a strong compliance culture within financial institutions. Compliance and auditing processes involve evaluating the effectiveness of AML programs and identifying areas for improvement. Regular audits help financial institutions maintain compliance with AML regulations and reduce the risk of penalties for non-compliance. The Financial Action Task Force (FATF) is an intergovernmental organization responsible for developing and promoting AML and counter-terrorism financing standards globally. It maintains a set of 40 Recommendations serving as the international AML policy benchmark. Regional AML regulatory bodies, such as the European Banking Authority and the Asia/Pacific Group on Money Laundering, help implement FATF Recommendations and coordinate regional AML efforts. They play a critical role in harmonizing AML standards across countries. National AML legislation and enforcement agencies, such as the U.S. Treasury Department's Financial Crimes Enforcement Network, enforce AML laws and regulations within their jurisdictions. They are responsible for investigating and prosecuting money laundering offenses. Digital currencies, such as Bitcoin, and blockchain technology pose new challenges for AML efforts, as they enable anonymous transactions and facilitate cross-border money movements. Regulators must adapt their strategies to address these emerging risks. Fintech and Regtech advancements have transformed the financial industry and created new opportunities for AML compliance. Innovative solutions, such as AI-powered transaction monitoring, can help detect and prevent money laundering more effectively. Cross-border money laundering activities are complex and difficult to detect, as they involve multiple jurisdictions and financial systems. International cooperation and information sharing are crucial for addressing this challenge. Artificial intelligence and machine learning offer significant potential for enhancing AML efforts by automating processes and improving the accuracy of risk assessments. However, they also raise concerns about data privacy and the ethical use of technology. Implementing global AML standards can be challenging due to differing legal frameworks, regulatory approaches, and political priorities among countries. Harmonizing these standards is crucial for fostering a consistent global response to money laundering threats. AML compliance is often costly and resource-intensive, requiring significant investments in technology, personnel, and training. Financial institutions must balance the costs of compliance with the need to protect their businesses and customers from financial crime. AML measures can unintentionally restrict access to financial services for vulnerable populations, such as refugees, low-income individuals, and small businesses. Policymakers must strike a balance between combating financial crime and promoting financial inclusion. Non-compliance with AML regulations can result in reputational damage, fines, and legal penalties for financial institutions and businesses. These risks underscore the importance of maintaining robust AML programs and staying abreast of regulatory changes. Collaborative efforts and information sharing among financial institutions can improve the effectiveness of AML measures by providing a more comprehensive view of financial activities. Public-private partnerships and information-sharing initiatives play a crucial role in combating money laundering. AML efforts play a crucial role in combating financial crime, maintaining the integrity of financial systems, and promoting economic stability. As money laundering threats evolve, so too must AML strategies and initiatives. The AML landscape is characterized by ongoing challenges and opportunities, including technological advancements, cross-border money laundering activities, and the need for global collaboration. Financial institutions, regulators, and governments must work together to address these issues and create a more secure financial environment. To ensure the continued effectiveness of AML efforts, stakeholders must embrace continuous improvement, adapt to emerging trends, and foster greater collaboration. By doing so, they can strengthen the global fight against money laundering and contribute to a safer and more transparent financial system. As AML efforts continue to evolve and improve, customers can have greater confidence in the security and integrity of their banking services. Individuals and businesses should take advantage of the range of financial products and services available while remaining vigilant and informed about the potential risks associated with financial transactions. By choosing reputable financial institutions and staying up-to-date on the latest AML developments, customers can help contribute to the collective effort against money laundering and financial crime.What Is Anti-money Laundering (AML)?

History of Anti-money Laundering

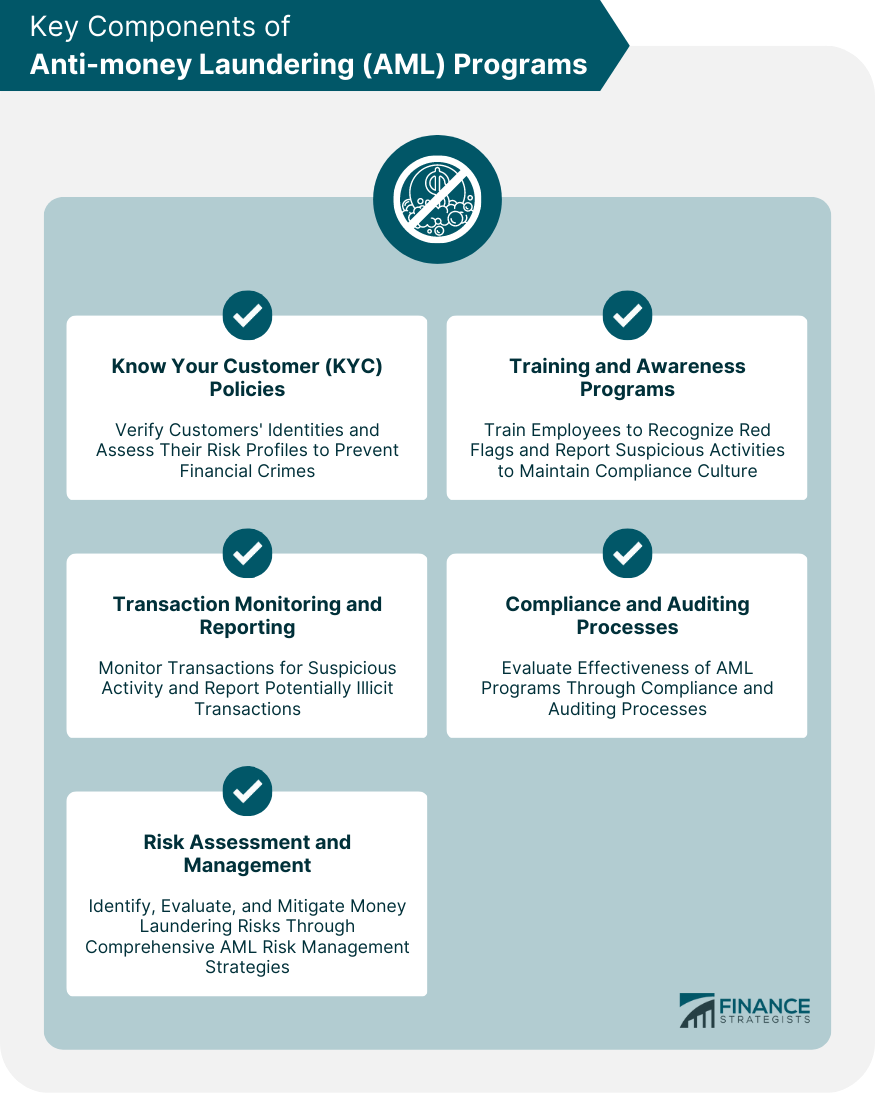

Key Components of AML Programs

Know Your Customer (KYC) Policies

Transaction Monitoring and Reporting

Risk Assessment and Management

Training and Awareness Programs

Compliance and Auditing Processes

Global AML Regulatory Framework

Financial Action Task Force

Regional AML Regulatory Bodies

National AML Legislation and Enforcement Agencies

Emerging Trends and Challenges in AML

Digital Currencies and Blockchain Technology

Fintech and Regtech Advancements

Cross-Border Money Laundering Activities

Integration of Artificial Intelligence and Machine Learning in AML Efforts

Challenges in Implementing Global AML Standards

Impact of AML on Financial Institutions and Businesses

Costs of AML Compliance

Effects on Financial Inclusion and Access

Reputation and Legal Risks for Non-compliance

Collaborative Efforts and Information Sharing Among Institutions

Final Thoughts

Anti-Money Laundering (AML) FAQs

Anti-Money Laundering (AML) refers to laws, regulations, and procedures aimed at preventing criminals from concealing illegally obtained funds or assets. AML measures help identify, track, and report suspicious financial activities.

The key components of AML programs include Know Your Customer (KYC) policies, transaction monitoring and reporting, risk assessment and management, training and awareness programs, and compliance and auditing processes.

Money laundering has been a part of human history for centuries, with early examples dating back to the Roman Empire. However, AML regulations and initiatives evolved over time, beginning with the Bank Secrecy Act of 1970 in the United States. The 1980s and 1990s saw the emergence of global AML efforts, including the establishment of the Financial Action Task Force (FATF).

Some emerging trends and challenges in AML include digital currencies and blockchain technology, fintech and regtech advancements, cross-border money laundering activities, the integration of AI and machine learning, and challenges in implementing global AML standards.

The impact of AML on financial institutions and businesses includes costs of compliance, effects on financial inclusion and access, and reputation and legal risks for non-compliance. Collaborative efforts and information sharing among institutions can improve the effectiveness of AML measures.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.