Retirement planning is the process of learning about, selecting, and executing financial solutions that will allow you to prepare sufficient funds for a comfortable and secure retirement. Planning for retirement begins with knowing your financial goals and finding the means necessary to accomplish them. It also involves identifying sources of income, estimating future expenses, developing a savings program, and managing assets and risks. Although this process can be intimidating, it does not have to be difficult. By starting early, considering all the crucial factors, and following the steps needed, you can prepare adequate resources for retirement.

At its most basic level, retirement planning is essential because it allows you to prepare the funds which will support your post-retirement needs. Unfortunately, for most retirees, Social Security benefits are insufficient to support their desired standard of living. Furthermore, with the recent advances in medical technology, they find themselves living longer and healthier lives. Thus, it has become even more critical to prepare for this milestone through retirement planning, which involves setting up alternative sources of income that can support you for as long as you need. Planning for retirement also helps manage risk. For example, it can help you protect your hard-earned savings from the effects of inflation and market volatility. It can also help you minimize the tax burden on your retirement income. Ultimately, retirement planning is crucial because it can enable you to live the lifestyle you want post-retirement, whether that involves traveling, engaging in hobbies, or funding your grandchildren’s education. Since this is such a crucial activity, planning and preparing for your retirement as soon as possible is recommended. Listed below are pointers for successful retirement planning at various life phases: Individuals entering adulthood may not have a substantial amount of money to invest. Still, they do have time to allow assets to develop, which is a crucial and significant component of retirement savings. If you are in this stage, it is recommended that you save as much as possible and increase it every time your financial situation improves. You may also invest more in high-risk options which can offer high returns because there is enough time to recover from possible market dips. These are some of the most vital years for proactive savings since most individuals earn more and still have enough time to let investments grow. However, a few financial burdens may accompany this stage, such as mortgages, school loans, insurance premiums, and credit card debt. Nonetheless, it is essential to continue saving at this point so that you can stay on track with your retirement goals. Individuals at this retirement planning stage may have already paid off previous financial burdens. They may also earn more but have limited time to save. If you are in this stage, it is recommended to continue saving. However, your investments should grow more conservative with age since there is less time to recover should there be dips in the market. When planning for retirement, there are several factors that must be considered, which include: Before investing for retirement, you must imagine the lifestyle you wish to maintain and estimate how much will be needed to fund it. This factor is crucial since more expenditure in the future demands increased savings in the present. If you underestimate your costs, you run the risk of not being able to enjoy the lifestyle you desire. It is vital to consider your age and the length of time before you retire. Thinking about this will help you make the right changes to your portfolio as you get closer to retirement. The longer the period between now and retirement, the greater your portfolio's risk tolerance can be. When you are younger, you can allocate most of your assets to riskier investments like equities. However, the older you get, the greater your portfolio's emphasis should be on income and capital preservation. Although the general rule of thumb is that younger individuals can invest more aggressively, the exact percentage of what to invest in high-risk vehicles may vary due to personal preferences. You can begin by determining which percentage of your income is essential and which can grow with some level of risk. Then you can check if you are comfortable with the risks that will be taken with your portfolio. Overall, the most suitable allocation is the one that balances your risk tolerance and investment goals. The amount you can obtain from your portfolio is not solely dependent on the market rate of return but also on the taxes you will have to pay on your investment gains. Thus, identifying your tax status is a critical step in retirement planning. This will help you compute the after-tax value of your investments so you can make logical choices about where to commit your resources. Another important consideration is estate planning, which ensures that your assets are managed and dispersed after your death in accordance with your wishes. A well-thought-out estate plan avoids the costly and lengthy probate process, which can eat into the funds you intended for your loved ones. Planning ahead can minimize the problems and provide more resources to your intended heirs. The following are key steps to take when planning for retirement: Step 1. Determine Your Retirement Goals Reflect on what you want your retirement to look like. For example, you can decide when you want to retire and if you want to maintain your current lifestyle. Step 2. Calculate How Much You Need to Save Next, estimate how much you will need to cover the expenses involved in your post-retirement lifestyle. There are various ways to do this, but using the 4% rule is a straightforward method. This rule states that you might need to withdraw 4% of your initial retirement savings each year to cover your expenses. So, if you want to retire with a $50,000 annual income for the next 25 years, you will need to save at least $1.25 million. Step 3. Set up a Retirement Savings Plan Set up a retirement savings plan. There are several options available. Some are employer-sponsored, like 401(k)s, while others, like Individual Retirement Arrangements (IRAs), can be opened even by self-employed individuals. You may also have the option to take advantage of more than one of these plans. It is essential to be aware of the tax implications of your selected plan. Some plans are tax-deferred, meaning taxes are only paid when withdrawals are made during retirement. Other plans are funded with post-tax dollars, earning tax-free withdrawals during retirement. Step 4. Invest Your Money The final step is to choose which financial vehicles to invest in within your plan. Many options are available, but the two most common are stocks and bonds. Stocks are generally riskier but offer higher possible returns, while bonds are less risky and focus more on capital preservation. You can distribute a certain percentage of your funds between riskier and safer options. This percentage can change as you age since your needs will change too. Thus, it is important to review and update your investments as needed. Below is a list of potential retirement plan options for you to consider: There are various employer-sponsored plans which vary depending on the nature of the business. For instance, major corporations usually offer 401(k)s, while 403(b)s are offered by some nonprofit organizations and public education institutions. There are also 457 plans which are offered to some government employees. Contributions to these accounts are deducted automatically from employee paychecks and invested in the vehicles they select. Employers may also contribute to their employee’s retirement savings, often through a matching system. A traditional IRA is a kind of individual retirement account available to anyone who earns income. It allows for pre-tax contributions and tax-deferred growth of investments. In retirement, the owner of a traditional IRA must pay income tax on withdrawals from the account. A Roth IRA is an individual retirement account funded by after-tax dollars. The primary advantage of a Roth IRA is that, unlike a standard IRA, contributions, and gains can be withdrawn tax-free upon retirement. A SIMPLE IRA is the small-business equivalent of a 401(k) plan which is subject to similar regulations as IRAs. This workplace retirement savings account enables qualified employees to invest a part of their pretax income and receive company contributions. Employers may contribute to their employee's retirement savings through matching or non-elective contributions. A pension is a retirement savings plan offered by employers that provides a guaranteed stream of income after retirement. However, this retirement option is less prevalent than it used to be. Nowadays, it is more commonly offered by employers in the public sector. An annuity is an insurance contract that allows you to save funds for a future income stream. It is similar to a pension, except that it is not tied to any employer. Any individual who can pay the required premiums may avail of an annuity option. Social Security is a government-sponsored retirement savings program. It is funded by payroll taxes and is a default component of nearly every American worker's retirement plan. Retirement planning is the process of learning about, choosing, and executing financial solutions that will prepare you for a comfortable and secure retirement. A good retirement plan ensures you possess enough resources to meet your future needs. Although Social Security benefits are available for most retirees, this is often not enough. Thus, alternative income sources that will last for as long as necessary must be created. There are numerous factors to consider when planning for retirement, such as the amount of money you will need to cover your expenses, your personal level of risk tolerance, and how much time you still have to prepare. Often, the current stage of a person's life influences their retirement planning activities. However, no matter your life stage, the steps to create a sound retirement plan remain the same. You can do this by determining your goals, calculating how much you need to save, then choosing a retirement plan and investing in financial vehicles of your choice. There are several different retirement savings plan options aside from the usual employer-sponsored plans. For instance, there are IRA plans, pensions, and annuities. Although retirement planning can be started individually, you may consult a financial professional to ensure that you select the most appropriate retirement plan and investment choices.What Is Retirement Planning?

Importance of Retirement Planning

Stages of Retirement Planning

Young Adulthood (From Ages 21 to 35)

Early Midlife (From Ages 36 to 50)

Later Midlife (From Ages 51 to 65)

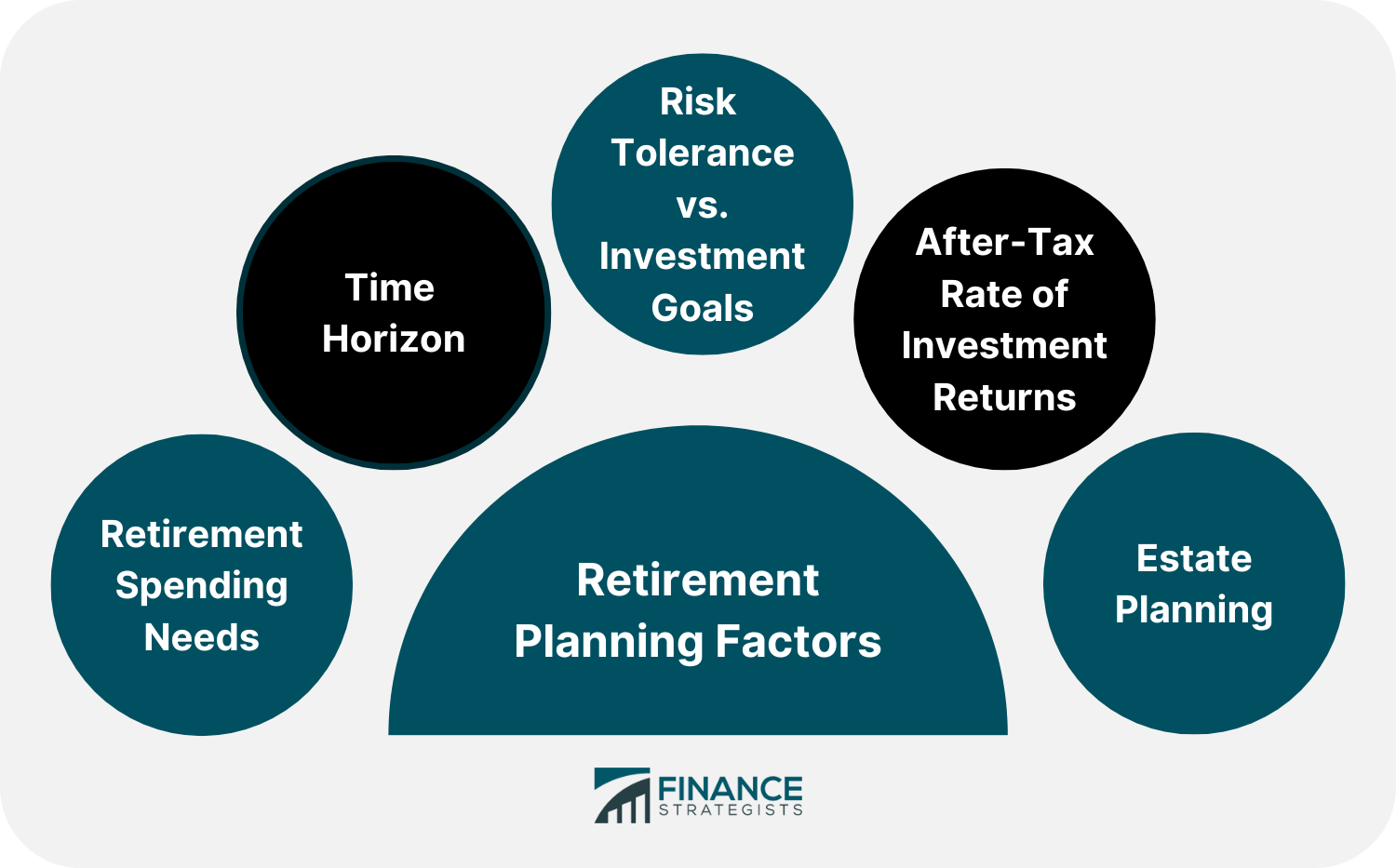

Factors to Consider in Retirement Planning

Retirement Spending Needs

Time Horizon

Risk Tolerance vs Investment Goals

After-Tax Rate of Investment Returns

Estate Planning

Steps to Retirement Planning

Retirement Plans and Investments

Employer-Sponsored Plans

Traditional Individual Retirement Account (Traditional IRA)

Roth Individual Retirement Account (Roth IRA)

SIMPLE Individual Retirement Account (SIMPLE IRA)

Pensions

Annuities

Social Security

The Bottom Line

Retirement Planning FAQs

The three stages of retirement planning are young adulthood, early midlife, and later midlife. In young adulthood, people have time to allow assets to develop, while in early midlife, people need to continue saving despite additional financial burdens such as mortgages or school loans. Later midlife is when people have limited time to save but may have higher salaries which means they can invest more.

In retirement planning, you should consider your spending needs, how long you have until you retire, and your personal risk tolerance versus your investment goals. You may also want to consider how taxes affect your retirement income and how your assets will be distributed after death.

Experts have several ways to calculate how much you must save for retirement. You can use the 4% rule, which involves withdrawing 4% of your initial retirement savings annually to cover your expenses for the next 25 years. You can also prepare 80 to 90% of your annual income to cover your retirement expenses. Whichever option is selected, the general rule of thumb in retirement planning is the more expected expenditures in the future, the more savings must be invested in the present.

It is never too early to start retirement planning. The sooner you start, the more time you will have to save and prepare for your future.

Having a significant amount of money saved for retirement will guarantee a secure lifestyle in the future. Retirement planning allows you to be financially independent in the future, so you do not have to rely on your children, grandkids, or other family members.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.