Financial advisors are professionals who help individuals and businesses make smart decisions with their money. They provide guidance on a wide range of financial matters, including investing, saving for retirement, and managing debt. Financial advisors receive their training in a variety of ways. Some may have a degree in finance or accounting, while others may have experience working in the financial industry. Advisors also receive certifications from issuing organizations that allow them to provide advice on specific financial topics. In most cases, certified advisors must pass one or more tests and be properly licensed. A good financial advisor will take the initiative to get to know your background, goals, and plans for the future. Once they have a clear understanding of your situation, they can help you develop a financial plan that is tailored to your unique needs. Have a question for a financial advisor? Click here. Financial advisors provide guidance and advice to help their clients make sound financial decisions. They tailor their services to fit the specific goals and objectives of each client. Below are some of the services that financial advisors offer to their clients. Financial advisors provide information about investments and evaluate how they may fit into a client's overall financial picture. For example, if you are considering investing in a new business venture, a financial advisor can help you determine whether or not it is a good idea. They can also provide guidance on how much money you should invest, and what kind of return you can expect. Financial advisors control possible threats to the assets of a client. They understand their client’s goals and risk tolerance in order to make appropriate recommendations and investment strategies and explain why they are suitable. Additionally, they research and monitor the market to stay up-to-date on economic trends and news that could affect their client’s portfolios. To cover the risks involved, a financial advisor may recommend and guide clients through insurance planning as a way of protecting oneself, family, assets, and businesses against untoward incidents. This service includes the evaluation of options and the development of plans and making arrangements to prepare for the future educational needs of loved ones. Debt management is the optimizing and planning of finances to keep up with the bills and debts that may have been accumulated. Advisors can provide management plans suitable to the budget and situation of the client to lower current debt. Financial advisors help clients prepare for their life in the future. Steps include setting goals after retirement and estimating the financial amount necessary to live a comfortable worry-free life upon retirement. In estate planning, a financial advisor identifies all of your assets and creates a comprehensive plan for their management, transfer, and distribution. They ensure that your assets are properly protected and your loved ones are taken care of after you are gone. Financial advisors examine the investment portfolio and suggest ways to minimize the tax burden, and provide tax preparation and planning advice. They suggest ways to invest in tax-advantaged accounts or recommend investments that have little to no tax charges. By helping investors understand the tax implications of different investments, investors maximize their returns while minimizing their tax liability. Financial advisors can be of varying types in order to meet the specific needs of diverse clients. While typically any bachelor’s degree is acceptable, having a strong background in finance and accounting is an advantage. Earning licenses and certifications can advance their career and credibility, and also help demonstrate their expertise and specialization. Below are the different types of financial advisors, their expertise, and their qualifications. Generally, fees will depend on the services that financial advisors will provide. Other factors that affect the rate include their length of experience, credentials, memberships, and certifications. Financial advisors may collect a fixed monthly or annual salary for their services. Rates usually vary from $50 per month to $500 per month (or more) based on the complexity of the service provided. The terms usually stipulate a set number of monthly or annual meetings with the advisor. This is suitable for those who do not have large finances but want regular access to an advisor. Fixed salary is also for advisors who are connected to firms and receive regular pay from employers. A common and traditional way of charging financial advising services is the Assets Under Management (AUM) model. Standard charges are from 0.5% to 2% of the assets being handled annually. It is typical for advisors to charge 1% and offer discounted rates when assets reach certain thresholds. For a few simple financial needs, an hourly pay arrangement is suitable for some clients to get their answers. Rates are between $100 to $500 per hour. Clients only pay the select time they require the services of an advisor. This is advisable for clients who value flexibility. A client can pay an advisor for a specific financial planning service they require. This is billed as a one-time payment usually starting at $500 per service. For example, an advisor can provide a planning session focusing on creating an education plan for a client and charge a fixed fee. Another way advisors earn is by commission. This is when advisors sell and offer a financial product, and receive a percentage, usually 3% to 6% of the sale amount. This is typical for insurance products, mutual funds, and some types of securities. A way to expand and scale up is through the hybrid model where advisors can be paid either by commission or by the percentage of assets under management or even service fee-based payment. A hybrid advisor is able to offer broad financial strategic options to clients and is not limited by their payment terms and conditions. Having a financial advisor gives you a professional and unbiased guide in your wealth management journey. There are several advantages to hiring one, including: By having a financial advisor, goal setting can be more practical and smart. Advisors can provide insights that would allow realistic targets and help keep clients on track. Financial advisors may point out the lack of insurance, profitable investments, and even retirement savings and can help clients set goals and guide them on how to achieve them. Going through personal and organizational financial data will eat out a lot of time and induce unnecessary stress. Having a financial advisor that will sweep through these numbers and provide an understandable and simple summary that can be used for goal setting and planning can save a lot of time and increase efficiency. As mentioned, finances deal with a lot of data and information and financial planning requires considering various factors that are full of uncertainties. The training, certifications, and wide experience of financial advisors enable them to identify these factors. They help ensure that clients are aware of and understand all their options and the potential risks and rewards associated with each option. Advisors constantly monitor progress and offer regular feedback. Before hiring a financial advisor, it is worth considering the following factors - assets, knowledge, and time. People who require advisors usually have a significant amount of assets or a complex financial situation. Advisors can manage and monitor progress, make decisions, and give recommendations. They are also updated with the latest changes in tax laws, which can be beneficial for clients. Likewise, people who are just starting to invest or have a simple financial situation may also benefit from working with an advisor. Advisors can provide insights and suggestions on how to best grow assets. They can also help develop a financial plan and monitor progress. Those who do not have enough time to monitor their finances or fully understand the financial planning process can also benefit from hiring an advisor. Having someone to constantly review progress and offer feedback can free up some time and save someone from risks that they may not have been aware of. There are a few things to keep in mind when looking for the right financial advisor, such as: The first thing to do is check if the potential advisor has the appropriate credentials and licenses. All financial advisors must have a license from the Financial Industry Regulatory Authority (FINRA). Some states also require additional licenses. It is important to note that there are different types of financial advisors, such as investment advisors and insurance agents. Make sure to check with the right regulatory body to ensure that the advisor is licensed to provide the services needed. Fiduciaries are legally required to put their clients' interests first. They must avoid conflicts of interest and disclose any that may arise. Not all financial advisors are fiduciaries, so it is important to check with the potential advisor before hiring. When looking for a financial advisor, it is important to consider the services offered and see if they fit your needs. Some advisors only offer investment advice while others may provide a full suite of wealth management services. Some advisors may also specialize in certain areas, such as retirement planning or estate planning. It is important to find an advisor that can cater to your specific needs. As mentioned, fiduciaries are required to avoid conflicts of interest. However, it is still important to check for any potential conflicts of interest that may arise. For instance, some advisors receive commissions for selling certain products. Make sure to ask about these commissions and how they are paid. It is also important to get everything in writing to avoid any misunderstandings later on. Fees charged by financial advisors vary depending on the services provided. Some charge by the hour while others may charge a percentage of assets managed. Make sure to ask about the fees charged and get everything in writing before hiring an advisor. This will help avoid any surprises later on. One of the best ways to find a reliable financial advisor is to get referrals from people you trust. Ask family and friends if they know anyone who can help with your finances. Financial advisors and planners both help people in dealing with their finances. The difference lies in the level of specialization and expertise, certification, and specific services demonstrated by both professionals. Financial advisors include a broad category of professionals who help manage money and offer financial products. Financial planners are a specific type of financial advisors who specialize in creating long-term financial strategies and goals. Financial advisors render a wide variety of services that can be tailored to the specific needs of their clients. They guide individuals to make smart financial decisions and provide them with financial expertise. They come with different backgrounds, training, experience, and certifications, it is important to consider these to know if they match your expectations and needs. Also, take note of their payment model to make sure that it is something you are comfortable with. They have the client's best interest at heart and work to ensure that their money is well-spent and growing. Financial advisors help take the guesswork out of financial planning so that their clients can focus on other aspects of their lives.What Is a Financial Advisor?

What Do Financial Advisors Do?

Investment Advice

Risk Management

Insurance Planning

Education Planning

Debt Management

Retirement Planning

Estate Planning

Tax Planning

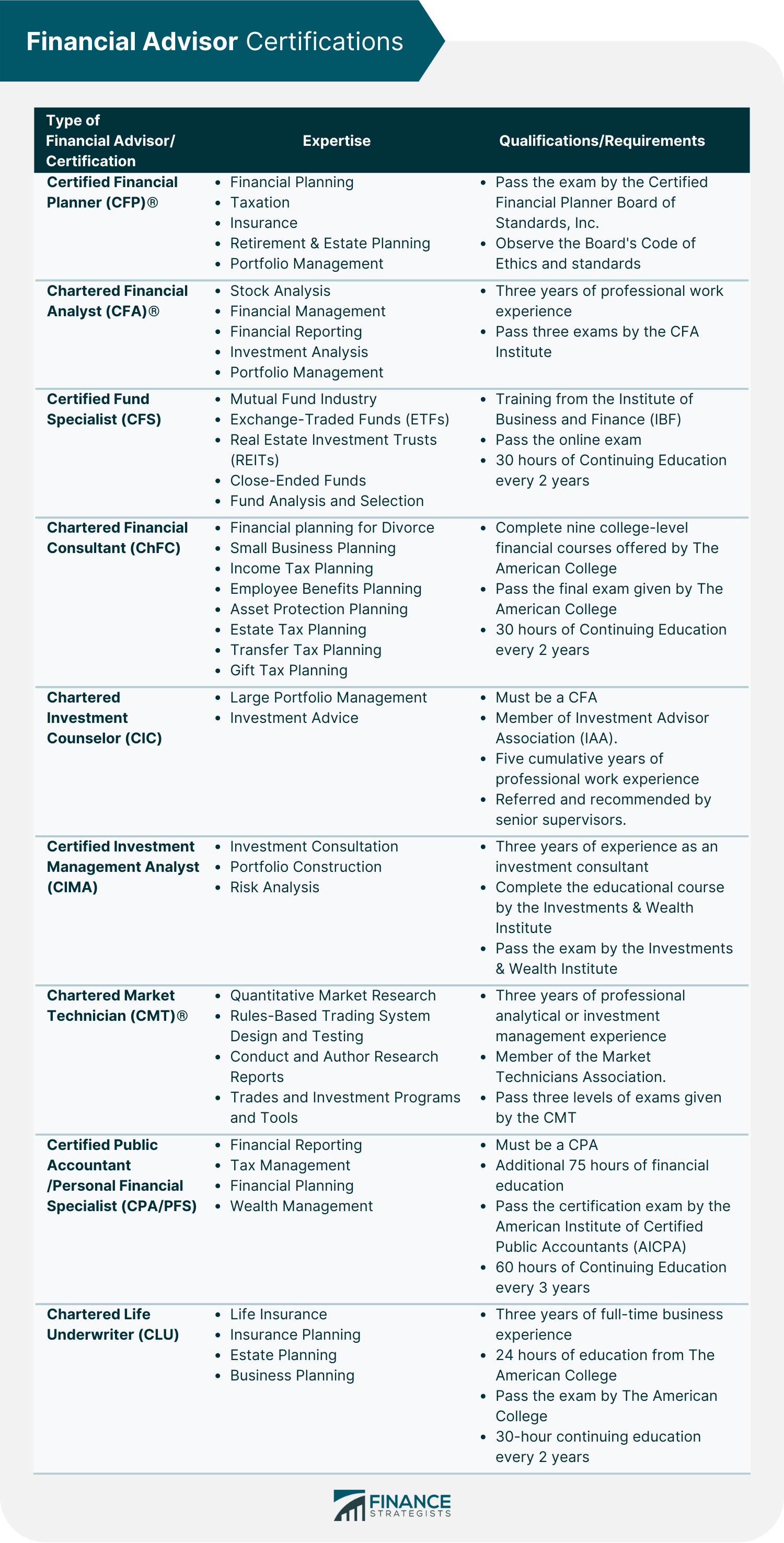

Types of Financial Advisors

How Much Do Financial Advisors Cost?

Fixed Salary

Based on Assets Under Management

Hourly

Fixed Fee-For-Service

Commissions

Hybrid Model

Benefits of Hiring a Financial Advisor

Offers Practical and Realistic Financial Goals

Promotes Time Management

Helps Reduce Stress

Who Needs a Financial Advisor?

Tips on Finding the Right Financial Advisor

Check Credentials and Licenses

Check if the Financial Advisor Is a Fiduciary

Consider the Services Offered

Check for Conflicts of Interest

Consider the Fees Charged

Get Referrals

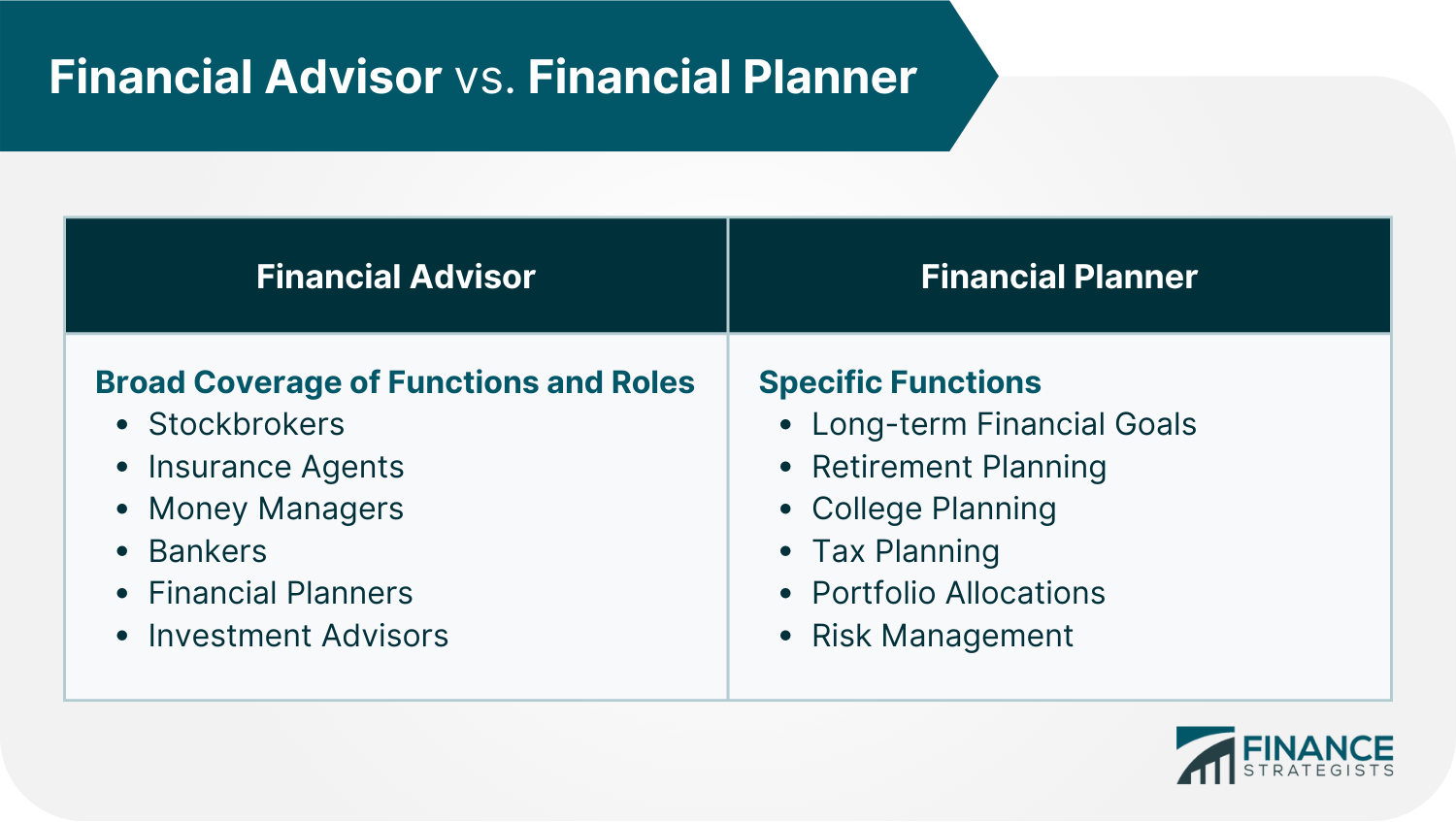

Financial Advisor vs Financial Planner

Final Thoughts

Financial Advisor FAQs

No easy answer is available to the question of whether or not financial advisors are worth it. Essential factors including your personal financial situation, your goals and objectives, and your comfort level with investing must be evaluated. There are some general points such as goals, asset value, time, and knowledge to consider that can help you decide if working with a financial advisor is right for you.

Individuals who are seeking financial advice because they do not have enough knowledge of investment and how to manage their assets can benefit from working with a financial advisor. Additionally, individuals who lack the time to monitor, analyze and plan their finances may also regard it valuable to enlist the services of a financial advisor. Ultimately, working with a financial advisor can help individuals make sound financial decisions and achieve their financial goals.

Financial advisors support individuals and businesses to make decisions about their finances. They take on the role of managing your finances and making sound investment choices. They may offer, depending on their specialization, guidance, and assistance in all aspects of financial planning, from budgeting and saving to retirement planning and investing. They help you build a solid financial foundation that will serve you well throughout your life.

Different financial advisors charge different fees for their services. Some may charge an average hourly rate of $100, while others may charge a percentage of assets under management typically marked at 1%. Others may also earn commissions at an average of 4% of the sale amount.

A Certified Financial Planner (CFP) is the highest level of financial advisor. A CFP is licensed by the Certified Financial Planner Board of Standards Inc. after passing a series of exams and working in the financial industry for a certain number of years. They work with clients to set financial goals and create a plan to meet those goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.