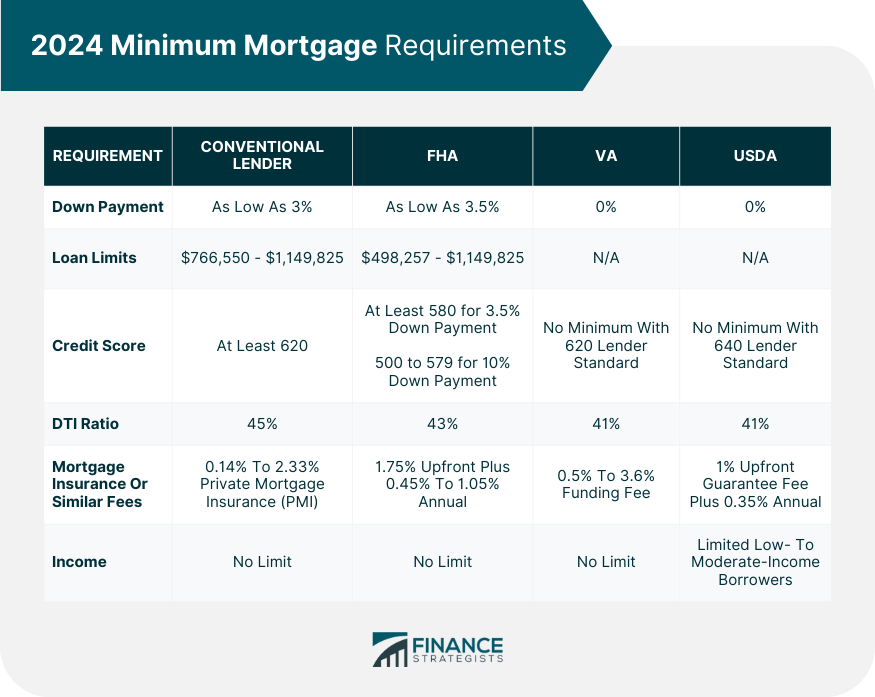

The requirements for mortgage loan applications vary slightly from lender to lender. Still, for a mortgage loan application to be approved, some fundamental criteria must be met, known as the four Cs: Capability, Capital, Collateral, and Credit. Have questions about mortgage loan applications? Click here. Lenders require borrowers to have a steady income from employment or other sources. The verification is done by looking over several years' worth of tax returns and income documentation. An employment background check is carried out occasionally. Monthly bills, student loans, and other obligations such as child support are also checked. All this information will give the lender an idea of whether you can carry the additional weight of a mortgage. Lenders are also looking to see if you have sufficient capital toward the down payment and closing costs. This gives them an idea of how you manage your money. Lenders typically require cash reserves from legitimate and allowable sources equivalent to six months of the mortgage payment, so they know you can cover the cost if, for example, you lose your job or have an unexpected medical or another emergency. In a mortgage loan application, this refers to the house you intend to buy. The lender will appraise the property to ensure it is worth the loan amount and may require proof of insurance. They will foreclose the house if you fail to make a certain number of mortgage payments. Additional collateral may also be asked of borrowers with lower credit scores and higher debt-to-income (DTI) ratios. Lenders will check your credit report, including payment history, the number and types of accounts open, age of accounts, current balances, and DTI ratios. They also consider the length of your credit history, recent applications for new forms of credit, bankruptcies or foreclosures, and collection and delinquent accounts. Ensure all your accounts are in good standing, as delinquent payments can stay on your record for up to seven years. After familiarizing yourself with the basic requirements for a mortgage loan, here are some tips on increasing your chances of getting approved: Review your credit report accuracy, as this will affect the interest rate you receive on loan and even make lenders deny your application altogether. TransUnion, Experian, and Equifax are each required to provide you with a free credit report once per year. Request a form from each of them alternately every four months instead of requesting it all at once. Examine if your debt payments are recorded correctly. Check that all records are yours and not someone else’s. For errors, contact the concerned agency for immediate corrections. Consider checking credit reports 4 to 6 months before applying for a mortgage loan to allow ample rectification time. The higher your credit score, the better your chances of getting approved and acquiring favorable interest rates. While conventional loans typically require a 620 credit score, some government loans accept scores as low as 500. To improve your credit score, pay off any debt with high-interest rates first. Build a positive payment history by using a secured loan. Refrain from closing unused accounts, as this can lower the average age of all accounts. Lastly, avoid taking on new debt, especially before your application. A co-signer may increase your chances of loan approval and help lower your interest rate. It is better if they have a higher credit score than you so their good record can compensate for any negative items on yours. Ensure they understand the risks associated with taking on this responsibility. They are liable to shoulder payments, their credit score can take a negative hit, and they may only be able to get new loans if you make timely mortgage payments. Lenders compare the amount of money you owe versus what you make and use it to determine if they should approve your application. Suppose you have a monthly income of $7,000 and a monthly debt payment of $4,000. Your DTI ratio of 57% means it is riskier to lend you money. It is best to keep your DTI ratio below 43%. You can improve this by making additional payments on existing debts, increasing your income, or reducing expenses. A higher down payment shows lenders that you are financially savvy and have the financial stability to make payments on time. They consider this a form of protection against borrower default. You may qualify for more favorable terms like lower interest rates and exemption from mortgage insurance requirements. Generally, lenders prefer a minimum 20% down payment, but this varies depending on the type of loan and other factors. You should explore other options. Try considering other lenders that offer more flexible lending criteria, lower interest rates, or higher mortgage amounts. Check out online lenders and credit unions, which may have fewer restrictions and better rates. Also, look into specialized lenders that cater to those with lower credit scores or unique financial needs. Comparing interest rates and fees is essential before committing to a new loan. Instead of attempting to buy an expensive home that stretches your financial limits, consider buying something more affordable. With a smaller amount of money owed on the mortgage, lenders may be willing to take more risks and offer more lenient terms. Look for a condo or a smaller house. You may also choose a neighborhood with better prices. You will be able to build equity and save up for a more expensive home in the future. Reach out to the lender’s representative and ask why they denied your loan application. Ask for a copy of the credit reports and home appraisal they used. Check and dispute details, such as if the appraisal is below the home’s market value. They should also justify less-than-favorable loan terms such as a higher interest rate or lower mortgage loan amount. A lender is required to provide a detailed and written explanation within 60 days. Analyzing this document can help you identify the causes and make any necessary adjustments to improve your financial profile before reapplying. Mortgage rates are expected to be lower in 2024 compared to previous years. Getting approved with lower down payments, more flexible credit scoring, and improved interest rate guidelines might be easier. Loan limits will also be raised, giving potential buyers more substantial borrowing power. Generally, it is easier to get a government-backed loan than a conventional one. Listed below are the minimum requirements for different mortgage applications in 2024: Conventional lenders require at least a 5% to 10% down payment, while those following guidelines set by Fannie Mae and Freddie Mac can get a house for as low as 3%. For government-backed loans under the Federal Housing Administration (FHA), it is set at 3.5%. Other government-backed mortgages, like those from the U.S. Department of Agriculture (USDA) and the Department of Veteran Affairs (VA), do not require down payments. VA loans are for active, reserve, and retired military personnel, while the USDA loans are for low- to middle-income borrowers looking to buy homes in rural areas. For conventional loans, the low-cost area limit is $766,550, while the high-cost area limit is $1,149,825. For FHA loans, new loan limits are between $498,257 and $1,149,825. These loan limits depend on the area of the country where you plan to buy your home. Areas with a lower cost of living are given a lower loan limit and vice versa. VA and USDA loans do not set loan limits. Conventional lenders require a minimum credit score of 620 to approve a mortgage loan, while the FHA requires 500-570, which they approve with a 10% down payment. To avail of the 3.5% down payment mentioned above, borrowers must have at least a 580 score. The VA and USDA do not set a minimum credit score, but their approved lenders typically follow industry standards of 620 and up to 640, respectively. The maximum DTI ratio accepted by conventional lenders is 45%. The FHA allows up to 43%, while the VA and USDA are both at 41%. A DTI ratio lower than 36% is best. Still, you may get approved with a higher DTI if you have other compensating factors, such as an established credit history, a large down payment, or higher cash reserves. Conventional loans with less than 20% down payment are required to pay private mortgage insurance (PMI), ranging from 0.14% to 2.33% depending on credit score. The FHA has different terms: an upfront 1.75% of the loan amount and an annual fee that ranges from 0.45% to 1.05%, included in the monthly mortgage payments. The VA and USDA loans do not require PMI. The VA has its own funding fee ranging from 0.5% to 3.6%. On the other hand, the USDA charges a 1% upfront guarantee fee plus an annual fee of 0.35%. A steady and stable income is required for approval in any mortgage loan application, ensuring the capability of a borrower to repay the debt. Conventional lenders typically require a two-year work history with steady employment. The borrower must have worked for 12 months at the same job before applying for government-backed loans. Self-employed borrowers must also provide proof of income in the form of tax returns and other documents that show they can support their loan payments. It should be noted that the USDA sets maximum limits on the income of potential borrowers since they are mandated to provide mortgage loans exclusively to low- to moderate-income households. The mortgage application process can be complex and intimidating. Still, with the proper knowledge, you can maximize your chances of getting approved. Remember the four Cs of qualifying for a mortgage: capability, capital, credit, and collateral. Aside from these, your can also check and correct your credit reports, improve credit scores and DTI ratio, work with a co-signer, pay a larger down payment, or choose a more affordable house to increase your chances at mortgage loan approval. In case you get denied, make sure to find out why and work with the lender on how to improve your application. With the proper preparation and guidance from a mortgage loan officer, you can be approved for a mortgage loan that suits your needs.Requirements for Mortgage Loan Application

Capability

Capital

Collateral

Credit

How to Get Approved for a Mortgage Loan

Check Your Credit Report

Check and Correct Any Mistakes

Improve Your Credit Score

Get Help From a Co-Signer

Calculate and Reduce Your DTI Ratio

Increase Your Down Payment

Consider Other Lenders

Consider Less Expensive Property

What to Do if Your Mortgage Application Is Denied

2024 Minimum Mortgage Requirements

Down Payments

Loan Limits

Credit Score

DTI Ratio

Mortgage Insurance

Income

Final Thoughts

How to Get Approved For A Mortgage Loan FAQs

The basic factors are the 4 Cs: capability, credit, collateral, and capital. These are affected by the size of the loan, the applicant's credit score, the type of income used to qualify for the loan, and any current debt obligations. Additionally, lenders may look at other items, such as job stability or other assets that could be used as collateral.

Several things may hurt your chances of getting a mortgage loan approved, like changing jobs, taking out new lines of credit, opening new accounts, paying bills late, or co-signing on another person's mortgage. It is essential to prove to the lender that you can repay the loan and have good credit standing.

Poor credit score, high debt-to-income ratio, insufficient down payment amount, and the type of loan requested can cause your application to be denied. Other factors include poor credit history, an unstable job, unverifiable income, too much-existing debt, and poor property conditions. Address these things before applying for a mortgage loan to increase your chances of approval.

The time required for mortgage approval can vary greatly depending on the lender and type of loan you are applying for. Generally, most lenders will need at least two weeks to review your application before making a decision. However, it is possible to get approved faster if you have all your paperwork in order and the lender is confident in their ability to assess your financial situation quickly. Occasionally expedited approval processes are also granted.

Lenders consider a variety of factors when evaluating mortgage applications. You will have greater chances of approval if you meet the different criteria set by lenders, from credit score, income, down payment amount, employment history, and more. Make sure to get clarification from the lender before submitting your application. With this, you are guaranteed a more positive outcome.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.