A bank statement is a document that displays all of the transactions that have taken place on a bank account over a given period of time. This can include money deposited, withdrawn, or transferred between accounts – whether it be debit card transactions at the point-of-sale (POS), electronic withdrawals via ATM, online, or even over-the-counter transactions. Bank statements can be used to track funds, reconcile accounts, review spending habits, and detect fraudulent transactions or payment errors. It contains bank account information, such as the account holder's name, account number, and a detailed list of deposits and withdrawals. Dates, time stamps, and third party details are also shown in each transaction so that the account holder can see and review information about who the payment was to or from. A bank statement shows the transactions made on a bank account during a certain period, detailing every activity or transaction. Typically, transactions on a bank statement appear in chronological order. Each time a transaction is made, the bank makes a record of it with the date, the nature of the transaction, and the dollar amount. It gives a starting and ending balance record so that the account holder will have a clear idea of the amount of money at the close of the month compared to its beginning figure. Bank account transactions are grouped into two categories: withdrawals and deposits. Withdrawals are the amounts of money that are taken out of the account. This includes point-of-sale (POS) transactions, ATM withdrawals, checks that are written and cashed, and debit card purchases. Deposits are the amounts of money that are put into the account. This includes cash and check deposits, incoming wire transfers and fund transfers, and direct deposits from an employer. The bank statement will also show any fees that were charged for the account, such as monthly service fees, overdraft fees, or insufficient funds fees. It is important to note that not all transactions may appear on a bank statement. For example, a pending transaction – such as a check that has been written but not cashed – will not appear on the statement until it has been processed by the bank. At the end of the statement period, a running balance will be reflected which shows the total amount of money in the account. Bank statements are essential documents that provide a detailed record of income and expenses. They can be used for several purposes, such as: Bank statements can help track progress in achieving savings goals. By reviewing deposits and withdrawals, account holders can see how much they are saving on a monthly or yearly basis. This information can be useful in making future financial decisions, such as whether to increase savings contributions. Bank statements can be used as proof of income when filing tax returns. The IRS requires taxpayers to provide detailed records of their income and expenses in order to correctly file taxes. Most taxpayers receive a W-2 form from their employer, which shows the total amount of money earned over the course of a year. However, taxpayers who are self-employed or have other forms of income will need to provide additional documentation, such as bank statements, to show how much money was earned. When applying for a loan, the lender will often require submission of bank statements as part of the application process. This is because bank statements can provide insight into a person’s financial history and ability to repay the loan. Bank statements can also be used to detect fraudulent transactions. By reviewing bank statements on a regular basis, any unauthorized activity in the account can be immediately spotted. If any are found, the account holder should contact their bank immediately. Bank statements can be used to calculate the amount of interest that has been earned on a deposit account. Account holders can use this information to compare the interest rates of different banks and make sure they are getting the best return on their investment. They may also use this information in deciding whether to change savings accounts or invest in other products that are more profitable. Bank statements ensure that account holders are aware of their current balance. This information can help avoid overdraft fees by keeping track of account balance and making sure there are sufficient funds to cover all transactions. Although banks typically have a good system to track and record transactions, mistakes can still happen from time to time. That is why it is important for account holders to review their statements carefully and report any errors or discrepancies to their bank. There are several formats of a bank statement depending on the financial institution. Take a look at this example: Bank statements are typically mailed to your home or available online through your bank's website. The majority of banks and credit unions allow bank account holders to view their bank statements online for free. It is convenient, especially since 78% of Americans prefer to bank digitally. The process may differ from bank to bank. However, some of the basic steps include: You can also change your account settings to "go paperless." This automatically sends you online statements instead of getting them in the mail. Some banks automatically send out your monthly bank statements by mail when you sign up for an account. The mailed statements will be the same as what can be viewed online. If you opt for paperless statements, you are giving the bank your consent to receive your bank statements online. But banks still must provide you with a paper copy of your bank statement if you ask. Here are steps to enable paper statements by mail: Some banks may charge you a service fee for mailing the paper statements since it costs them to print and mail them to you. From then on, you will start receiving paper statements in the mail. You may call your bank if you cannot log in online or if you have questions about how to enable paper statements. Bank statements include information that identity thieves and scammers can use to commit fraud. That is why it is essential to keep your bank statements secure. Here are some tips you can do to secure your bank statements: A bank statement is a document that displays all the transactions in your bank account for a specific period. Bank statements can be used to track your spending, see where you can cut back on expenses, and catch errors or unauthorized transactions. When you open a bank account, you will be asked how you want to receive your monthly statements. You can opt to receive them online or by mail. It is important to keep your bank statements secure to protect your personal and financial information from identity thieves and scammers. To keep your bank statements secure, shred them before throwing them away, and never respond to unsolicited requests for your personal or financial information. Monitor your account activity regularly and know the fraud policies of your bank in case your account is compromised. Bank statements are a vital part of tracking your finances and keeping your information secure. By understanding what a bank statement is, how it works, and how to keep it safe, you can make the most of this important document. What Is a Bank Statement?

How Bank Statements Work

Uses of a Bank Statement

Tracking Savings

Filing for Tax Returns

Applying for Loans

Detecting Fraudulent Transactions

Determining Earned Interest

Monitoring Account Balance

Checking For Any Errors or Discrepancies

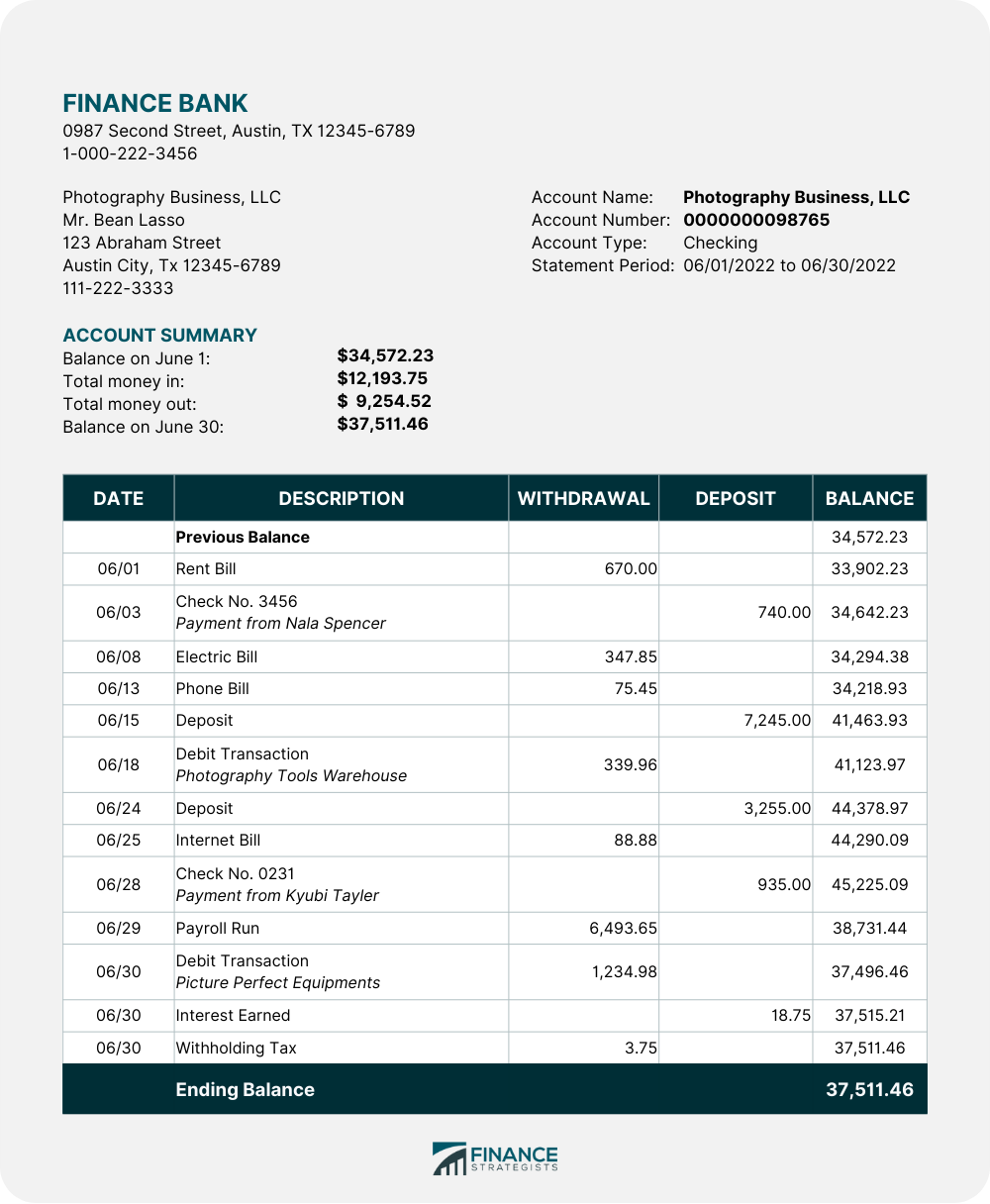

Bank Statement Example

How to Access Your Bank Statement

Electronic Statements

Paper Statements by Mail

Find under headings like "services" and "account setting" to find where you can request mailed statements and choose "By Mail."

Keeping Your Bank Statements Secure

The Bottom Line

Bank Statement FAQs

Bank statements are documents that show all the transactions in your bank account for a specific period of time.

Bank statements are usually free. Some banks may charge you a certain fee for mailing the paper statements since it costs them to print and mail them to you.

Bank statements can be requested online or by mail. You may call your bank if you cannot log in online or if you have questions about how to enable paper statements.

Bank statements requested online are typically available immediately. Bank statements requested by mail may take a few days to arrive.

Some banks may charge a fee for mailing paper statements since it costs them to print and mail them to you.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.