Private banking is a particular service that provides personalized and comprehensive financial solutions to high-net-worth individuals and families. They offer a more customized and tailored approach. These services include various financial services such as wealth management, investment advice, tax planning, and estate planning. Private bankers work closely with clients to understand their financial goals and aspirations and offer customized solutions to help them grow, protect, and manage their wealth. Private banks typically have strict eligibility criteria. To become eligible for private banking services, clients must meet specific financial thresholds, usually at least $1 million in liquid assets. The main objective of private banking is to provide clients with excellent service and privacy.

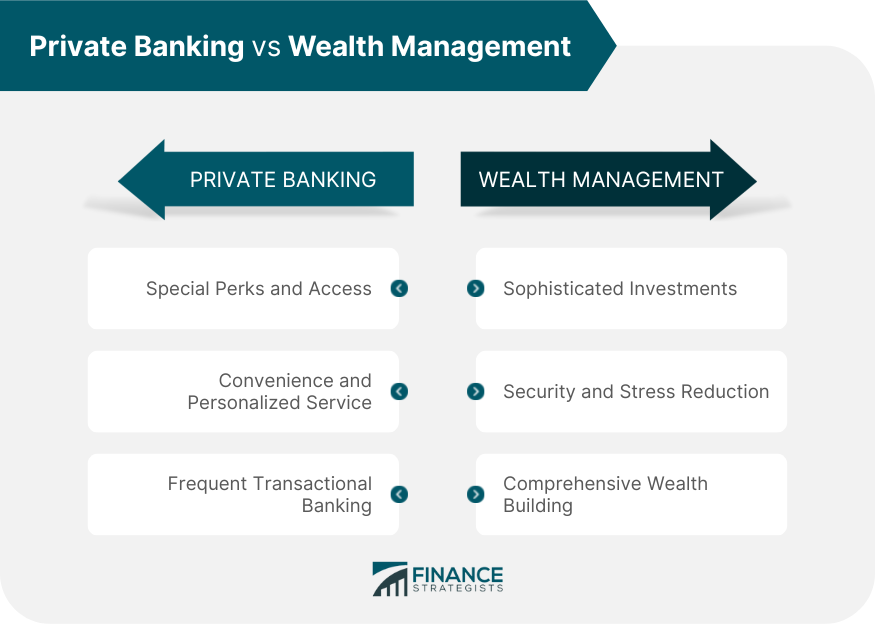

The process begins with the client being introduced to a private banker, who serves as the main point of contact and manages the client's portfolio. Such bankers perform complex tasks, such as arranging large mortgages and routine tasks like bill payments. The private banker takes the time to understand the client's financial situation and then creates a customized financial plan that considers the client's current position, financial goals, and any risks or challenges. Once the financial plan is in place, the private banker helps the client implement the plan by recommending and arranging appropriate financial products from bonds, mutual funds, and real estate. Similarly, such bankers advise on tax and estate planning. Throughout the process, the private banker remains in close communication with the client, regularly reviewing their financial situation and making adjustments as needed. This ongoing relationship ensures that the client's financial goals stay on track. Any changes or challenges that come along can be addressed promptly and effectively. In addition to these standard services, private banking offers specialized services such as wealth preservation and intergenerational wealth transfer. Private banking services offer specialized financial solutions to high-net-worth individuals. To be eligible for private banking, clients must meet specific criteria regarding their wealth, investments, and personal qualifications. The qualifications differ among financial institutions. Nevertheless, these services are primarily intended for individuals and families with a high net worth, which the Securities and Exchange Commission (SEC) defines as having a minimum of $750,000 in investable assets. Some private banking services require having a minimum of $1 million invested with the bank. This can be in the form of money market funds, stocks, bonds, or other assets held through the bank. Other factors that may be considered include liquidity of holdings, income level, business interests and affiliations, and age or investment experience. In addition to monetary thresholds, private banking clients must also meet specific personal qualifications. These include having a solid credit history and being trustworthy with finances and investments. Bankers may request additional documentation, such as tax returns and other financial documents, to evaluate a potential client's credentials. Services from a private bank come with several costs and fees, depending on the nature of the service and the amount of wealth managed. Generally speaking, private banks charge a percentage of assets under management (AUM), typically at 1%. This fee is usually assessed quarterly or annually in conjunction with account maintenance fees. On top of these fees, some private banks may also charge transaction fees or foreign exchange fees. Other private banks get compensated for commissions earned on selling financial products. In this case, the clients do not pay any direct costs. Further, fees for private banking services may be exclusive or in addition to commissions. Occasionally, specific fees may be waived if the client maintains a minimum balance. Private banking is an exclusive financial service that offers numerous benefits: A single platform allows clients to access various services, from investment management, wealth planning advice, trust services, estate planning, insurance coverage, and more. Such a solution allows clients to focus on overall wealth management strategy. Each client is assigned a private banker who understands the client's financial situation and provides tailored financial advice. Further, clients can access specialized knowledge and experience from bankers who understand private banking services in greater detail. Private banking clients typically have access to attractive interest rates and reduced fees on various financial products and services. This includes lower fees on bank accounts and loans. At the same time, savings and investment accounts may have higher interest rates. Many private banks also offer exclusive benefits and perks, such as unique event invitations or discounts offered through partnered organizations and concierge services. Additionally, they can have priority access to financial products and services. Private banking services are typically more expensive than ordinary investments available to the general public. Aside from this fact, there are other drawbacks to consider. Smaller private banks often have lower levels of expertise than larger financial institutions due to limited staff training and development. This can lead to fewer options and recommendations provided by bankers. Clients may not receive the financial advice and solutions they need to manage their wealth effectively. Furthermore, private banks may have limited resources and expertise in niche areas, such as complex tax planning or alternative investments. Private banking services may also have limited product offerings compared to larger financial institutions. This means that clients may not have access to the full range of financial products and services that they require, preventing them from maximizing portfolio diversification. High employee turnover rates can result in clients having to start over in building a relationship with their banker. This leads to a lack of trust and confidence in the services provided by the private bank and the potential loss of important information and context. The relatively close relationship that clients may have with their bankers could lead to conflicts of interest where decisions taken by the banker are not necessarily in the client's best interest but beneficial for the banker or institution itself. For example, private bankers may be incentivized to sell certain financial products that generate higher commissions, even if they may not be the best for the client. It is important for clients to always independently verify information shared by their banker before taking any action. Each of these banks offers a wide range of financial services and products and serves a global client base with a strong presence in multiple countries: Union Bank of Switzerland (UBS). UBS is a private bank headquartered in Zurich, Switzerland, established in 1862. With $3.1 trillion in AUM, the bank consistently ranks among the largest private banks in the world. Bank of America. Established in 1930, with headquarters in North Carolina. With $3.07 billion in AUM, the bank provides various services to clients such as personal, corporate, institutional, and government agencies. Wells Fargo. Headquartered in San Francisco, Wells Fargo was established in 1852. It has an AUM of over $1.9 trillion, serves over 70 million customers in the U.S., and offers a range of financial services to businesses and individuals worldwide. Morgan Stanley. Founded in 1935 in New York, it is a leading global financial services firm with over $1.3 trillion AUM. The bank provides financial services to numerous clients, including individuals, corporations, and governments. Citibank. Citibank is part of Citigroup, a global financial services company with over 200 years of history. It serves clients in over 160 countries, with over $2.3 billion in AUM. When considering the options for managing your finances, it is important to understand the differences between private banking and wealth management. If you want access to specialist advice for security and to reduce stress associated with sophisticated investments, wealth management is the way to go. Whereas, if you want special perks and convenience as a client who regularly conducts transactional banking activities, private banking is for you. Wealth management provides a holistic approach and a thorough understanding of client’s financial situation. The emphasis of these services is on ensuring long-term financial success. On the other hand, if a personalized service is a priority, then private banking may be more suitable. It is important to weigh options carefully in order to make an informed decision that best aligns with your financial goals. Private banking is a highly personalized and complete financial solution that provides tailored financial services and advice to high-net-worth individuals and families. They have a dedicated private banker that helps create a customized financial plan and provides ongoing support. Eligibility criteria for private banking services typically include a minimum wealth requirement and other qualifications such as income, financial literacy, or professional experience. Costs of private banking include an annual fee for the assets managed and fees and charges associated with financial products and services used. These costs can be high, but for many clients, the benefits of private banking may make it an attractive option. Private banking allows access to personalized service, all-in-one financial solutions, attractive interest rates, reduced fees, and exclusive perks. Its drawbacks include low expertise, limited product offerings, high employee turnover, and potential conflicts of interest. UBS, Bank of America, Wells Fargo, Morgan Stanley, and Citibank are five major private banks worldwide. Each of these banks offers a wide range of financial services and products to various clients globally. Private banking, explicitly designed for high-net-worth individuals, represents a valuable resource when used responsibly. Ultimately, deciding to engage in private banking will depend on the individual's financial goals and priorities. What Is Private Banking?

How Private Banking Works

Private Banking Eligibility Requirements

Costs of Private Banking

Pros of Private Banking

All-In-One Financial Solutions

Personalized Service

Attractive Interest Rates and Reduced Fees

Exclusive Benefits and Perks

Cons of Private Banking

Low Expertise Compared to Larger Financial Institutions

Limited Product Offerings

High Employee Turnover Rate

Potential for Conflicts of Interest

Real-World Example of Private Banking

Private Banking vs Wealth Management

Final Thoughts

Private Banking FAQs

Private banking is typically intended for high-net-worth individuals and families with substantial assets and investable wealth. Eligibility criteria for private banking can vary among financial institutions, but clients usually need a minimum investment threshold. In addition to financial requirements, private banks also consider clients' investment goals, risk tolerance, and financial sophistication when determining eligibility for their private banking services.

The advantages of private banking include personalized service, access to all-in-one financial solutions, attractive interest rates, reduced fees, and exclusive benefits and perks.

The potential drawbacks of private banks include low expertise, limited product offerings, high employee turnover rate, and potential conflicts of interest.

The cost of private banking can vary based on the financial institution and services used. Generally, there is an annual fee for the assets managed. In addition, fees associated with investment products or other services will also be included in the total cost of private banking. There may be some commission-based fees, as well.

Private banking focuses on highly personalized banking services, while wealth management focuses on long-term financial planning and wealth accumulation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.