Estate administration is a legal process that takes place after a person's death to manage and distribute their assets to their beneficiaries. The process involves identifying the deceased person's assets and liabilities, paying off debts and taxes, and distributing the remaining assets to the beneficiaries according to the instructions in the will or, if there is no will, according to state laws. Estate administration can be complex and time-consuming, which is why many people choose to hire an estate planning lawyer to assist with the process.

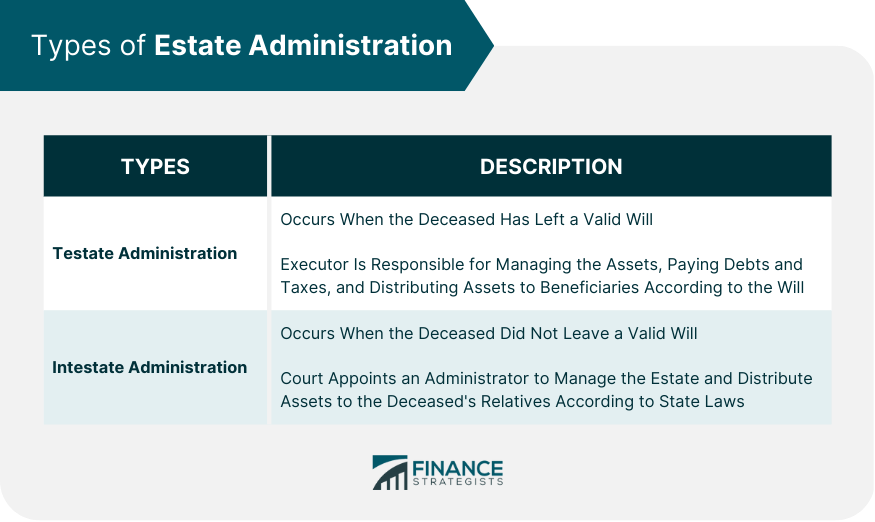

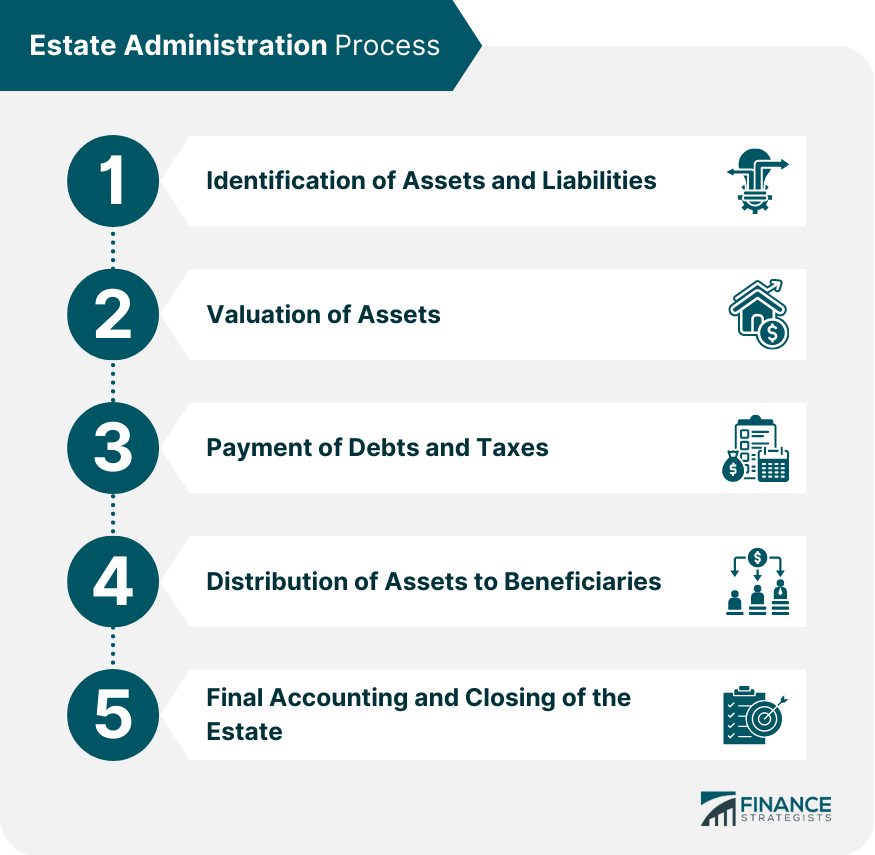

There are two main types of estate administration: testate and intestate administration. Testate administration occurs when the deceased has left a valid will. In this case, the person named as the executor in the will is responsible for carrying out the instructions contained in the document. The executor has the authority to manage the deceased person's assets, pay off debts and taxes, and distribute the remaining assets to the beneficiaries according to the will. Intestate administration occurs when the deceased did not leave a valid will. In this case, the court appoints an administrator to manage the estate. The administrator's role is similar to that of an executor, but they must distribute the assets according to the laws of the state where the deceased resides. The distribution will typically be made to the deceased person's spouse, children, or other close relatives. The estate administration process can be lengthy and complex, but it is necessary to ensure that the deceased's assets are distributed correctly. The following are the steps involved in the process: The first step in estate administration is to identify all of the deceased person's assets and liabilities. This includes any property, bank accounts, investments, personal belongings, and debts. The executor or administrator must take an inventory of all these assets and liabilities and ensure that they are accurately valued. Once all the assets and liabilities have been identified, the executor or administrator must have them valued. This is necessary to determine the estate's total value and ensure that the assets are distributed fairly among the beneficiaries. Valuation can be done by a professional appraiser or by using asset market values. The executor or administrator must ensure that all debts and taxes the deceased person owes are paid off before the assets can be distributed to the beneficiaries. This includes any outstanding loans, mortgages, credit card debts, and taxes. The executor or administrator must also file the deceased person's final tax return. Once all the debts and taxes have been paid, the executor or administrator can distribute the remaining assets to the beneficiaries. This should be done according to the instructions contained in the will or, if there is no will, according to the laws of the state. The distribution should be done fairly and with the best interests of the beneficiaries in mind. After all of the assets have been distributed, the executor or administrator must prepare a final accounting of the estate. This includes a detailed report of all the assets, liabilities, and expenses involved in the administration process. Once the final accounting has been approved by the court, the estate can be closed. The role of an estate administrator is to manage the estate administration process and ensure that the deceased person's assets are distributed correctly. The following are the roles and responsibilities of an estate administrator: The executor is the person named in the will who is responsible for managing the estate administration process. The court appoints the administrator to manage the estate if there is no will or if the executor named in the will is unable or unwilling to serve. The roles of the executor and administrator are generally the same, although an executor has more authority since they are named in the will. The duties of an estate administrator include identifying and valuing the assets and liabilities of the estate, paying off debts and taxes, distributing assets to the beneficiaries, and preparing a final accounting of the estate. The administrator must also follow all state and federal laws and regulations related to estate administration. The estate administration process can be complex, and several challenges may arise during the process. The following are some of the most common challenges: Disputes among beneficiaries are common in estate administration, especially if the deceased did not leave a clear will. Beneficiaries may disagree about the distribution of assets or the valuation of certain assets, which can cause delays in the process. Some estates are more complex than others, and they require more time and expertise to manage. For example, the estate administration process can be more complicated if the deceased person owned a business or had significant investments. The estate administration process can be delayed for many reasons, including disputes among beneficiaries, incomplete information about the deceased person's assets and liabilities, or legal challenges to the will. Hiring an estate administration attorney is essential for several reasons: Estate administration attorneys deeply understand state and federal laws related to estate administration. They can ensure that the process is conducted legally and that all the necessary steps are taken. An estate administration attorney can provide valuable assistance if the estate is complex. They can help identify and value assets and liabilities, manage beneficiary disputes, and ensure all legal requirements are met. If there are legal challenges to the will or disputes among beneficiaries, an estate administration attorney can provide legal representation and protect the interests of the executor or administrator. Estate administration is an essential process that must be carried out after someone has passed away. It involves identifying and valuing the deceased person's assets and liabilities, paying off debts and taxes, and distributing the remaining assets to the beneficiaries. There are two main types of estate administration: testate and intestate administration. The process can be complex, and several challenges may arise, including disputes among beneficiaries, complex estates, and delayed administration. To ensure that the estate administration process is conducted legally and efficiently, it is highly recommended to seek the assistance of an estate planning lawyer. An estate planning lawyer can provide valuable guidance on estate planning and administration, help avoid potential disputes among beneficiaries, and provide legal representation if necessary. What Is Estate Administration?

Types of Estate Administration

Testate Administration

Intestate Administration

Estate Administration Process

Identification of Assets and Liabilities

Valuation of Assets

Payment of Debts and Taxes

Distribution of Assets to Beneficiaries

Final Accounting and Closing of the Estate

Roles and Responsibilities of an Estate Administrator

Executor vs Administrator

Duties of the Estate Administrator

Challenges in Estate Administration

Disputes Among Beneficiaries

Complex Estates

Delayed Administration

Importance of Hiring an Estate Administration Attorney

Legal Expertise in Estate Laws and Regulations

Assistance in Complex Estates

Protection Against Potential Legal Challenges

Final Thoughts

Estate Administration FAQs

Estate administration is the process of managing a deceased person's assets and liabilities, with the aim of distributing those assets to the rightful beneficiaries.

There are two types of estate administration: testate administration, which occurs when the deceased left a valid will, and intestate administration, which occurs when the deceased did not leave a valid will.

The role of an estate administrator is to manage the estate administration process and ensure that the deceased person's assets are distributed correctly. This includes identifying and valuing the assets and liabilities of the estate, paying off debts and taxes, distributing assets to the beneficiaries, and preparing a final accounting of the estate.

Some common challenges in estate administration include disputes among beneficiaries, complex estates that require more time and expertise to manage, and delayed administration due to incomplete information about the deceased person's assets and liabilities.

Hiring an estate administration attorney is essential to ensure that the process is conducted legally and efficiently. An estate planning lawyer can provide valuable guidance on estate planning and administration, help avoid potential disputes among beneficiaries, and provide legal representation if necessary.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.