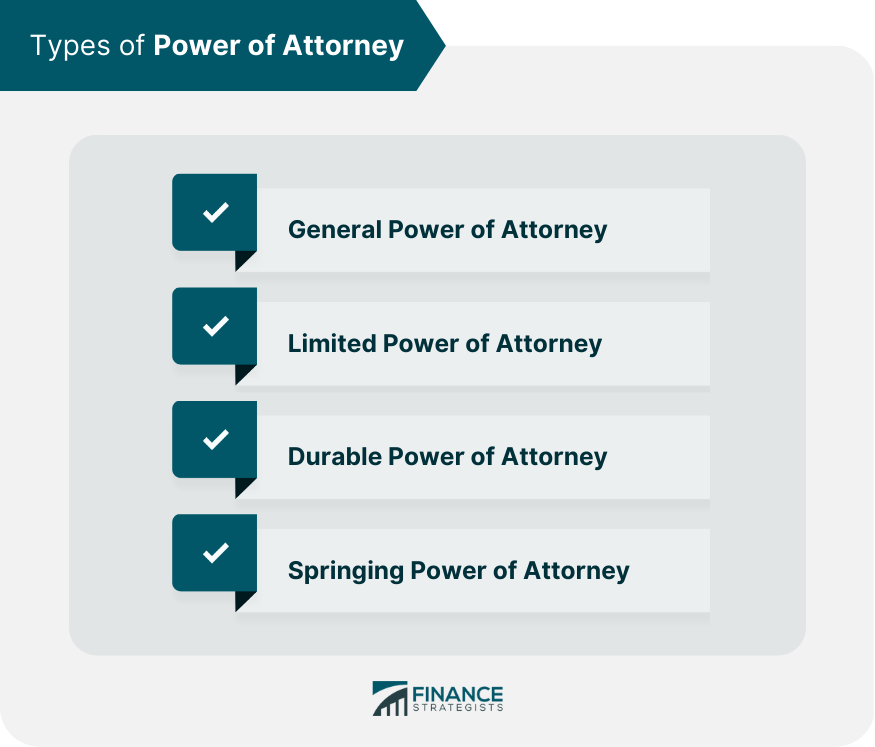

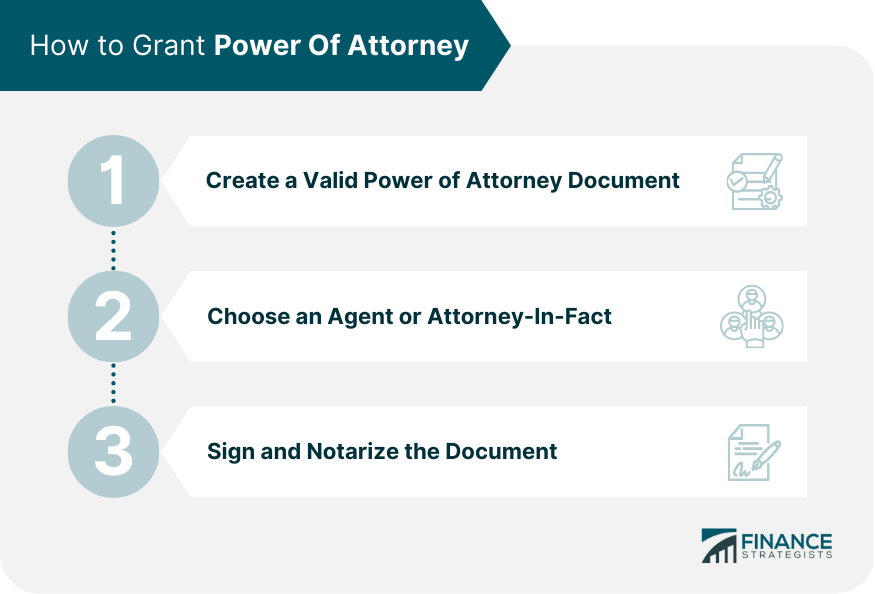

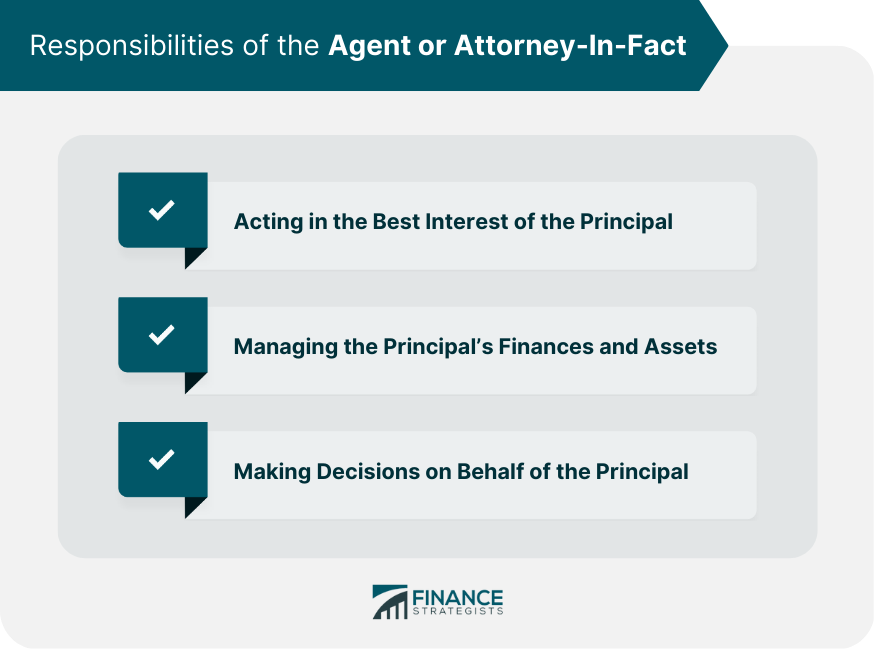

A power of attorney is a legal document that authorizes an individual to act as a representative of another person in specific circumstances. An individual who grants the power of attorney is called the principal, whereas the individual acting on their behalf is known as the agent or attorney-in-fact. This legal arrangement is useful in situations where the principal cannot decide for themselves due to illness, injury, or absence. It is important to understand how power of attorney works because it grants significant powers to the agent and can have a significant impact on the principal's finances, property, and personal affairs. Once the power of attorney document has been created, the principal must choose an agent who they trust to manage their affairs. The agent must have the necessary skills and knowledge to carry out the duties assigned to them and must act in the best interests of the principal at all times. Several types of power of attorney can be used depending on the circumstances. The most common types include: This type of power of attorney grants broad authority to the agent to act for the principal in various legal and financial matters. It is typically used for short-term situations and is terminated when the principal becomes incapacitated or dies. Another type is the limited power of attorney. This type of power of attorney grants limited authority to the agent to act on behalf of the principal in specific situations or for a specific period of time. It is often used for a specific transaction, such as buying or selling property. This kind of power of attorney remains in effect even if the principal is incapacitated or unable to make decisions for themselves. It can be either general or limited in scope. It is important to know that this power of attorney only goes into effect when a particular event or condition occurs, such as the principal becoming incapacitated. It can be either general or limited in scope. To create a valid power of attorney, there are several things that must be considered. These include: The principal must have the capacity to understand the nature and consequences of the power of attorney, must not be under duress or undue influence, and must have the intention to create a power of attorney. The power of attorney document must be specific as to the powers granted to the agent and the circumstances under which those powers can be exercised. In addition, the document must be signed by the principal and, in some cases, by witnesses. Choosing an agent or attorney-in-fact is an important decision that should not be taken lightly. The agent should be someone who the principal trusts and who has the necessary skills and knowledge to carry out the duties assigned to them. The agent should also be willing to act as the principal's agent and must agree to accept the responsibilities associated with the role. When choosing an agent, the principal should consider their age, health, and location, as well as their experience and qualifications. Once an agent has been chosen, the power of attorney document must be signed and notarized to make it legally binding. The notary public is a person authorized by the state to witness the signing of legal documents and to verify the identity of the parties involved. The notary public will require the principal to present identification and sign the document in their presence. In some cases, witnesses may also be required to sign the document to verify the principal's identity and to attest to their capacity to create a power of attorney. Once the document has been signed and notarized, the agent has the authority to act on behalf of the principal, as specified in the document. The agent or attorney-in-fact has the following responsibilities: The agent or attorney-in-fact has a fiduciary duty to act in the best interest of the principal at all times. This means that they must manage the principal's finances and assets responsibly and make decisions that are in line with the principal's wishes. They should keep accurate records of all transactions and should be prepared to provide an accounting of their actions to the principal or their legal representative upon request. The agent should also keep the principal's interests separate from their own and should avoid any conflicts of interest that may arise. The agent is responsible for managing the principal's finances and assets, which can include paying bills, managing bank accounts, buying or selling property, and managing investments. They should keep the principal informed of any significant transactions or changes to their financial situation and should seek their input on important decisions. The agent should also be prepared to provide regular reports to the principal or their legal representative. The agent may be required to make decisions on behalf of the principal in various situations, such as medical decisions, legal matters, and financial transactions. The agent should make these decisions in accordance with the principal's wishes, as expressed in the power of attorney document. If the principal's wishes are unclear, the agent should make decisions that are in the best interest of the principal based on their knowledge of the principal's values and beliefs. There are several limitations inherent in a power of attorney assignment: While a power of attorney can provide significant benefits to the principal, it also has some limitations that should be considered. One of the most important limitations is the scope of authority granted to the agent. The power of attorney document must be specific as to the powers granted to the agent, and the agent must not act outside the scope of their authority. If the agent acts outside the scope of their authority, they may be liable for any damages that result. It is important for the principal to carefully consider the powers granted to the agent and to ensure that they are specific and appropriate for their needs. Another important limitation of a power of attorney is that it can be terminated or revoked by the principal at any time. A power of attorney may be terminated by the principal if they have the capacity to do so. The principal may also include specific termination provisions in the document, such as a specific date or event that triggers the termination of the power of attorney. If the power of attorney is terminated, the agent is no longer authorized to act on behalf of the principal. In addition to termination, the principal may also cancel the power of attorney at any time, either by written notice to the agent or by executing a new power of attorney document. Revocation of a power of attorney is a serious step and should be taken only after careful consideration of the consequences. Once a power of attorney has been revoked, the agent no longer has the authority to act on behalf of the principal. There are many situations where a power of attorney can be useful, including: Medical Emergencies: If the principal becomes incapacitated due to illness or injury, the agent can make medical decisions on their behalf. Financial Management: If the principal is unable to manage their finances due to illness, injury, or absence, the agent can pay bills and manage their bank accounts. Travel Abroad: If the principal is traveling abroad and needs someone to manage their affairs while they are away, a power of attorney can be useful. A power of attorney is a legally binding document that enables an individual to authorize another person to act on their behalf under specific circumstances. Several types of power of attorney exist, including general, limited, durable, and springing power of attorney. The principal must meet specific requirements to establish a valid power of attorney, such as understanding the document's nature and consequences and selecting an agent or attorney-in-fact they trust to manage their affairs. The agent has several duties, such as managing assets and finances, making decisions in the principal's best interests, and acting on their behalf. Nevertheless, there are limitations to power of attorney, such as scope-of-authority restrictions and the principal's right to terminate or revoke it. It is advisable to consult an estate planning lawyer to safeguard your rights and interests while creating or using a power of attorney.What Is a Power of Attorney?

Types of Power of Attorney

General Power of Attorney

Limited Power of Attorney

Durable Power of Attorney

Springing Power of Attorney

How to Grant Power of Attorney

Create a Valid Power of Attorney Document

Choose an Agent or Attorney-In-Fact

Sign and Notarize the Document

Responsibilities of the Agent or Attorney-In-Fact

Acting in the Best Interest of the Principal

Managing the Principal’s Finances and Assets

Making Decisions on Behalf of the Principal

Limitations of Power of Attorney

Restrictions on the Scope of Authority

Termination of Power of Attorney

Revocation of Power of Attorney

Examples of Situations Where Power of Attorney Is Useful

Final Thoughts

Power of Attorney FAQs

It is a legal document that permits one person to appoint another person to act on his or her behalf in certain circumstances. The agent is authorized to make decisions and take actions on behalf of the principal as if they were the principal themselves.

The different types of power of attorney include limited, general, durable, and springing power of attorney.

To grant power of attorney, the principal must meet certain requirements, such as having the capacity to understand the nature and consequences of the document, and must choose an agent or attorney-in-fact who they trust to manage their affairs.

The agent or attorney-in-fact has several responsibilities, such as acting in the best interest of the principal, managing their finances and assets, and making decisions on their behalf.

There are several limitations to be aware of, such as restrictions on the scope of authority and the fact that a power of attorney can be terminated or revoked by the principal.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.