Indexed universal life insurance is an insurance product that combines a death benefit with an investment component. It is a permanent form of insurance since it remains in effect for as long as premiums are paid on time or until the maturity date mentioned in the policy. Maturity dates can happen when the insured person reaches a certain age, ranging from 85 to 121, depending on the terms outlined in the policy. Rather than providing a fixed interest rate, the cash value part of an IUL is linked to the performance of a market index, such as the Standard and Poor's 500 (S&P 500). The cash value part of the IUL is not directly invested in the stock market, so policyholders will not lose money on any downturns like they would on an index fund. Instead, the insurance company protects the principal against losses and guarantees a minimum interest rate, regardless of the market's performance. Unfortunately, the maximum interest rate remains the same, even if the market outperforms it. Indexed universal life insurance policies are somewhat flexible since there is an option to divide assets between the fixed and indexed components of the policy. There is also an option to modify death benefits or premium payments within specified limits. When purchasing an indexed universal life insurance policy, the insurance company may help clients pick an index for the cash-value portion of the policy, or they may pre-select one. Some providers also offer options for more than one index. When premiums are paid, a portion of the payment is allocated to the death benefit. Another percentage covers the policy's administrative costs and the insurance's actual cost. The remaining balance is sent to the cash value account. The total cash value accumulates interest based on increases in the chosen index, but it is not directly invested in the stock market. Instead, the insurance company tracks the index. It then determines the amount to be credited based on several factors, such as the index’s performance, the minimum guaranteed interest rate, the maximum interest rate or cap, and the participation rate. Gains from the index are paid back to the policy either monthly or annually. Once the cash value has grown to a certain level, policyholders can take out some of their money as a loan. These informal loans do not need to be paid back, but they will be deducted from the calculation of the total death benefit later. Interested parties should know about six key features of Indexed Universal Life Insurance. Indexed universal life insurance is permanent, meaning it may last for the policyholder's entire lifetime, provided that premiums are paid on time, and the maturity date has not yet been reached. The cash value portion of an IUL policy is linked to the performance of a specific stock market index such as the S&P 500 or the Nasdaq Composite. IULs typically offer a minimum guaranteed interest rate which remains the same even if the market performs poorly in comparison to it. Unfortunately, IULs have a maximum return or cap on the possible interest rate that can be earned in a given period. This restriction may hinder the cash value growth, even if the chosen index has performed exceptionally well. IUL policies offer a more flexible arrangement when compared to retirement accounts such as the 401(k). If they wish, policyholders may contribute more to their policy to speed up their cash value accumulation. The cash value of an IUL grows tax-deferred, meaning policyholders will only have to pay taxes on their earnings once they withdraw them. Indexed universal life insurance policies offer the following benefits: The death benefit is exempt from income and death taxes. In most cases, it is also not subject to probate. Unlike retirement plans such as the 401(k), there is no annual contribution limit for IULs. Qualified policyholders may be permitted to make contributions above $100,000. Just like a Roth IRA, policyholders may make tax-free withdrawals to the amount they contributed to the cash value portion of an IUL are tax-free. The cash value of IUL insurance plans can be withdrawn without penalty fees at any time, regardless of the policyholder's age. Policyholders can borrow money from their IULs without incurring fines or a credit check. They are also not required to pay back the money they withdraw. Indexed universal life policies also have certain drawbacks that must be considered, including: Most insurance companies place a cap on how much interest can be earned on the cash value portion of the policy. When the market has a good year, policyholders' money will yield less than if they had invested directly in the stock market. While IUL contributions can be withdrawn tax-free, earnings made on top of these original funds are subject to tax upon withdrawal. While it is true that indexed universal life insurance can deliver greater returns than regular life insurance in good years, the extra costs connected with an IUL can drain the policy's value. These costs can include sales commissions, mortality charges, and administrative fees. When looking for insurance, individuals should consider whether they are comfortable with premiums that increase as they age. Premiums on universal life insurance products like IULs all increase as the policyholder ages. With this, it may be prudent to explore life insurance policies with premiums that stay constant for the duration of the policy. Another point to consider is that indexed universal life insurance policies are associated with higher prices and risks. As an alternative, some financial experts advise individuals to purchase low-cost term life insurance and invest their savings instead. While IUL policies have several advantages, they may not suit everyone. They may be more appropriate for those who want to participate in market success but do not want to be fully exposed to possible declines. IULs and 401(k) plans are long-term investment vehicles offering tax breaks and growth potential. However, there are some critical differences between them. With an IUL, returns are linked to the performance of an underlying index. If the index does well, policyholders will earn a higher interest rate. But if the index underperforms, returns may decrease. Returns may also decrease because insurance companies limit the interest rate credited to IULs each year, regardless of how the underlying index performs. For example, they may set a cap rate of 3% or 4% annually. However, IULs offer a minimum guaranteed return which protects policy holder’s cash value even in a market downturn. In a 401(k) plan, employees are not limited to investing only in index mutual funds. They can also select actively managed funds, target-date funds, and other securities based on their time frame for investing goals and risk tolerance. The rate of return in a 401(k) plan is linked to how well those investments perform. For example, if the value of the chosen securities goes up by 20%, the 401(k) balance will increase by 20% as well. Another advantage of a 401(k) plan is that employers may offer matching contributions, providing free money to increase employees' retirement wealth further. In contrast, policyholders are responsible for the entire premium cost of an indexed universal life insurance policy. Taxation is another significant distinction between indexed universal life insurance and 401(k)s. Policyholders may borrow against the cash value of an indexed universal life insurance policy without incurring capital gains tax or penalties unless they surrender the policy altogether. Another advantage is the tax-free transfer of death benefits from an indexed universal life insurance policy to the policyholder’s beneficiaries. In contrast, 401(k)s typically restrict penalty-free access to funds before age 59.5, even during times of difficulty. However, a tax penalty may be waived if funds are used for eligible medical expenses, although income taxes will still be charged on the withdrawn amount. Employees may also take out a 401(k) loan, which has its own tax implications. If they leave their job with outstanding loan debt and do not return it in full, the entire amount may be considered a taxable distribution, subjecting it to a 10% penalty fee if under the age of 59 ½. Furthermore, if employees pass away with a loan balance in their 401(k), the beneficiaries who inherit the money will have to pay taxes on those funds. IULs and 401(k)s are investment options that offer different benefits. Individuals looking for potential cash value growth and death benefit protection may prefer IULs, while those mainly interested in retirement savings may prefer 401(k)s. Indexed universal life insurance is an insurance product that offers the potential for cash value growth based on the performance of an underlying index, such as the S&P 500. IULs also offer a death benefit to help provide financial protection for loved ones. IULs have several vital features, including premium flexibility, the ability to take out policy loans, and tax-free death benefits. IULs also have some drawbacks, such as additional fees and the potential for cash value growth to be limited by a participation rate or cap. Individuals must consider their financial goals and objectives when deciding whether an IUL is the best option. Speaking with an insurance broker can help individuals determine if an IUL fits within their overall financial strategy. Individuals may also want to compare IULs with other investment options, such as 401(k) plans, to see which better suits their needs. Indexed universal life insurance can be a helpful tool for building cash value and providing financial protection for loved ones. When used correctly, IULs can be an excellent way to help reach long-term financial goals.What Is an Indexed Universal Life (IUL) Insurance?

How IULs Work

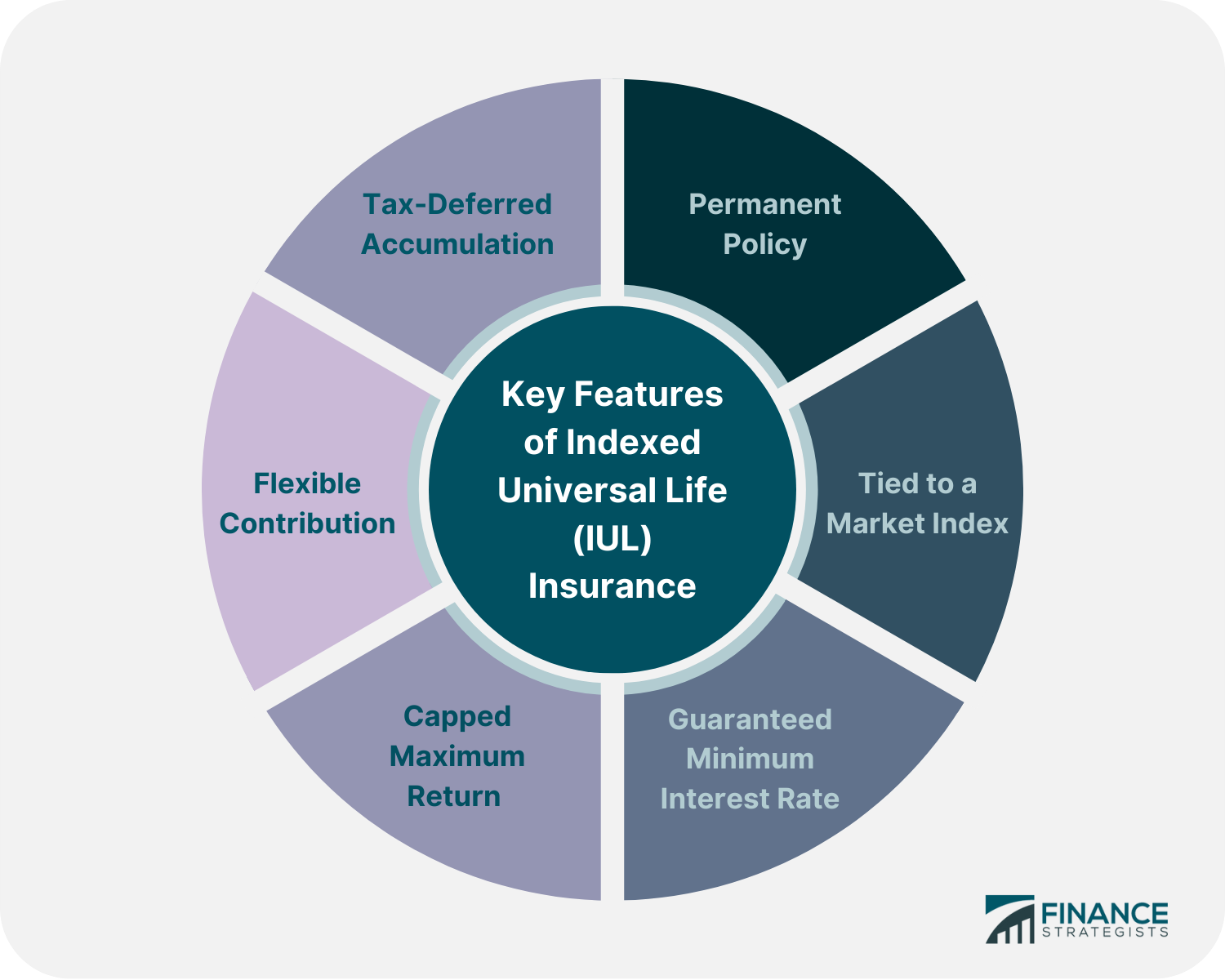

Key Features of IULs

Permanent Policy

Tied to a Market Index

Guaranteed Minimum Interest Rate

Capped Maximum Return

Flexible Contribution

Tax-Deferred Accumulation

Benefits of IULs

Tax-Free Death Benefit

Unlimited Contributions

Tax-Free Withdrawals

Easy Withdrawals

Loan Availability

Drawbacks of IULs

Limitation on Maximum Earnings

Taxable Income

High Fees

Should You Get an IUL?

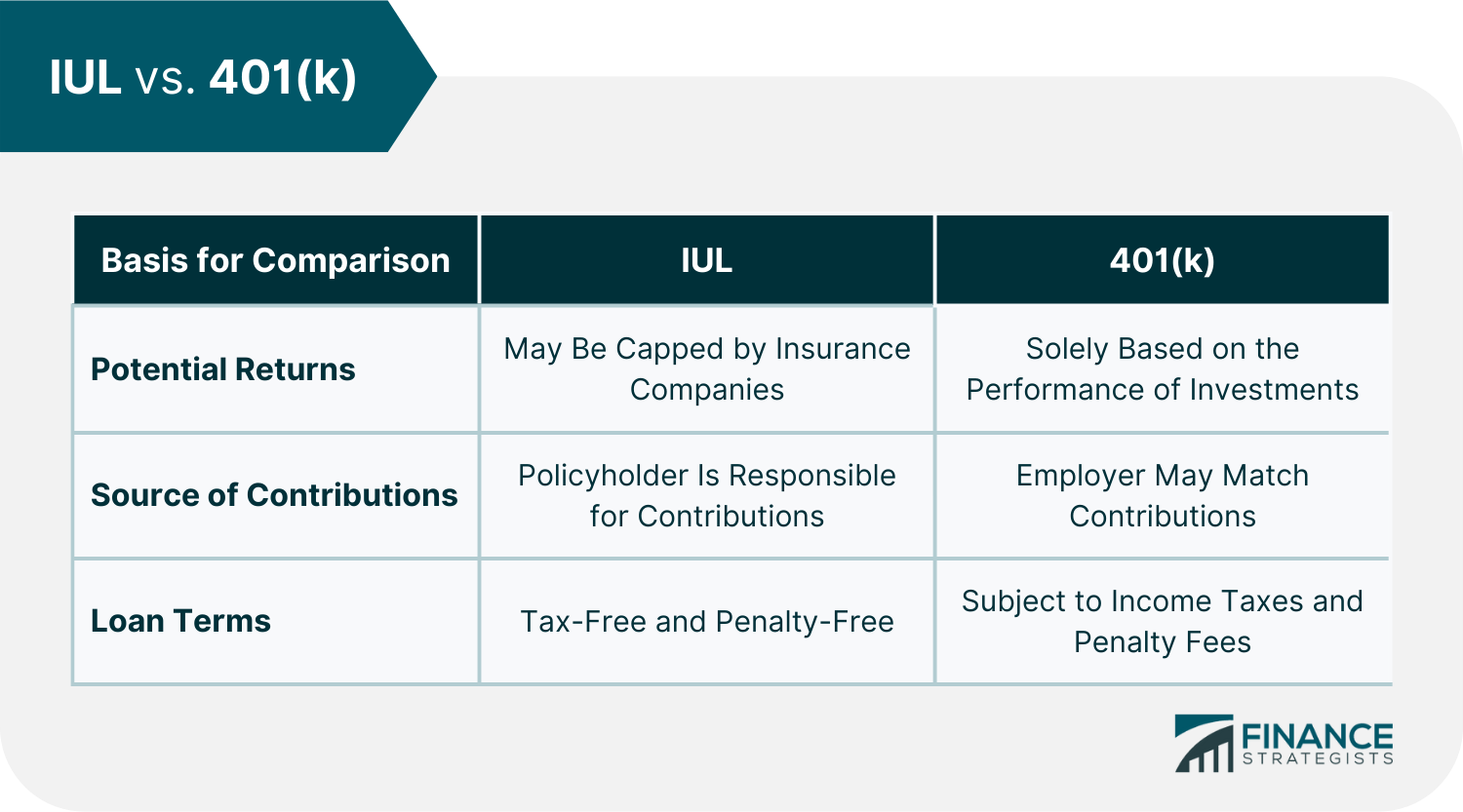

IUL vs. 401(k)

Final Thoughts

Indexed Universal Life (IUL) Insurance FAQs

Indexed universal life insurance policies (IULs) are a type of insurance product that offers both a death benefit and the potential for cash value growth based on the performance of an underlying index.

IULs can be a good investment for people looking for potential cash value growth and death benefit protection. However, IULs also have additional fees that may reduce the cash value and death benefit.

IULs offer several benefits, including the potential for cash value growth, premium flexibility, and the ability to take out policy loans.

It depends on the policy owner’s financial goals. IULs and 401(k)s are investment options that offer different benefits. Individuals looking for potential cash value growth and death benefit protection may prefer IULs, while those mainly interested in retirement savings may prefer 401(k)s.

It is unlikely that individuals would lose money in an IUL because insurance companies provide a guaranteed minimum interest rate to safeguard the principal from market losses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.