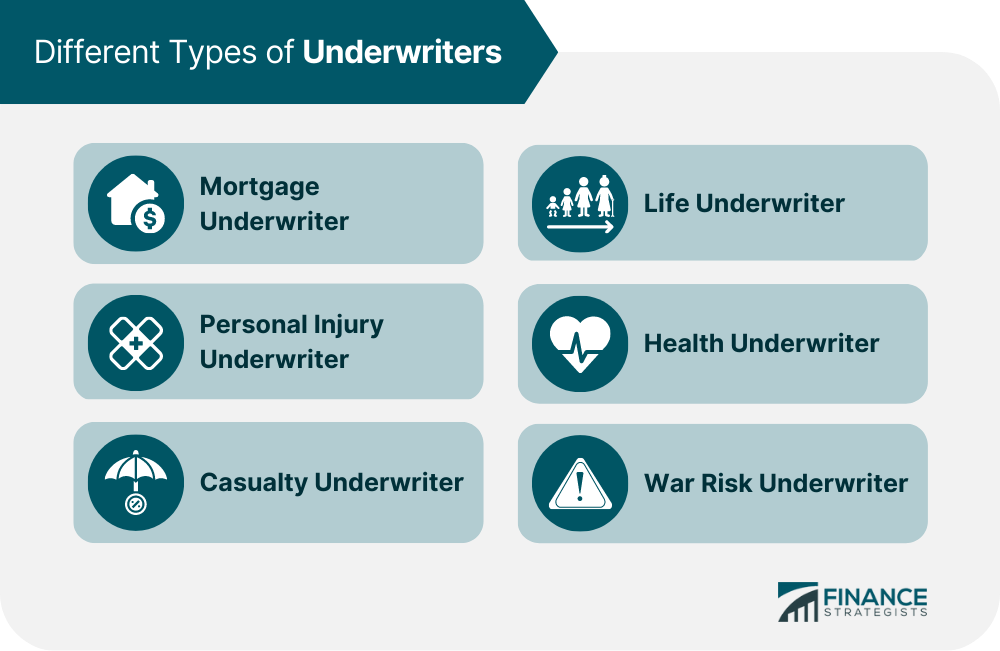

The term underwriter refers to a person or a group of people who are responsible for assessing different items that require taking on some sort of risk. In the financial world, an underwriter is someone employed by a lender to assess creditworthiness and other factors involved in borrowing money. Underwriters determine the level of risk associated with different types of lending opportunities. They may work directly for companies that are in the business of making loans, or they may be employed by insurance companies that provide protection against specific types of financial loss. For example, an underwriter at a life insurance company might determine which applicants will be approved for coverage, based on their age, family history, and state of health. There are different types of underwriters that are used in finance, with each having a specific set of skills relevant to their area of expertise. Some examples include mortgage underwriters, personal injury underwriters, casualty underwriters, life underwriters, health underwriters, and war risk underwriters. A mortgage underwriter will assess the risk of offering a loan for homeownership to someone, taking into account factors such as their credit history and purpose for borrowing. A personal injury underwriter will assess the risk associated with insuring someone who is involved in an accident that leads to injuries. A casualty underwriter will assess financial risks related to damages caused by natural disasters or acts of war. A life underwriter will assess the risk of insuring someone's life, using factors such as their age and family history as a guide. A health underwriter is responsible for determining whether an applicant should be approved to receive coverage through a health insurance company or not. Factors assessed may include the applicant's age, pre-existing conditions, family history, and state of health. A war risk underwriter assesses the risk of insuring against damages related to acts of war. Underwriters help you with your finances by assessing risks so that lenders can make informed decisions about whether or not to offer you credit. People who work in the financial industry often need to rely on underwriters to assess the quality of loans, bonds, and other types of credit. Here are some steps that you can take to understand whether your business needs an underwriter: If not, look for financing services that don't require risk assessment so your business will be able to secure the financial help it needs. Alternatively, a person can become an underwriter by earning a degree in finance or business. A person must have the following qualifications in order to be hired as an underwriter by a company: Here are some tips on how companies can go about hiring the right person for this position: Underwriters help you with your finances by assessing risks so that lenders can make informed decisions about whether or not to offer you credit. People who work in the financial industry often need to rely on underwriters to assess the quality of loans, bonds, and other types of credit. When a person is applying to get a loan or credit, the company that they are applying to will assess how likely they are to repay it so that they can determine who gets the loan and what interest rate they should be charged. An underwriter ensures that decisions made by companies using risk assessment techniques such as this one are accurate and fair and that the company is not over-charging or underpaying their customers. It takes a lot of training and experience to become an underwriter, but it can be very rewarding because you'll get to protect other people's money while also protecting your own investment in the company. The Duties of the Underwriters

The Different Types of Underwriters and the Services They Offer

Mortgage Underwriter

Personal Injury Underwriter

Casualty Underwriter

Life Underwriter

Health Underwriter

War Risk Underwriter

How Underwriters Can Help You With Your Finances

How Can I Find Out If My Business Needs an Underwriter

What Qualifications Does Someone Need in Order to Be Hired as an Underwriter by a Company?

Tips on How Companies Should Go About Hiring The Right Person for This Position

Final Thoughts

Underwriter FAQs

Underwriters make decisions about whether or not to give people loans and at what cost. They help companies determine the risk of offering someone credit, which is one of the factors that companies take into account when they are looking for loan applicants.

To find out if your business needs an underwriter, ask yourself whether you are looking for financing that requires a risk assessment. If so, then hiring either an in-house or third-party underwriter is a solution that may work well for your company.

In order to be hired as an underwriter, a person needs to have at least these qualities. These include being able to evaluate risk, assess creditworthiness and financing options, tell a story about financial issues clearly and concisely, possess good communication skills verbally and in writing, and be highly organized.

While brokers connect people with lenders, underwriters make decisions about whether or not to give people loans. This means that underwriters assess risk for companies and brokers help individuals find credit.

To become an underwriter, you need to have business training in addition to a degree. You will generally be expected to work your way up from entry-level jobs and gain experience working as a credit analyst or account manager.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.