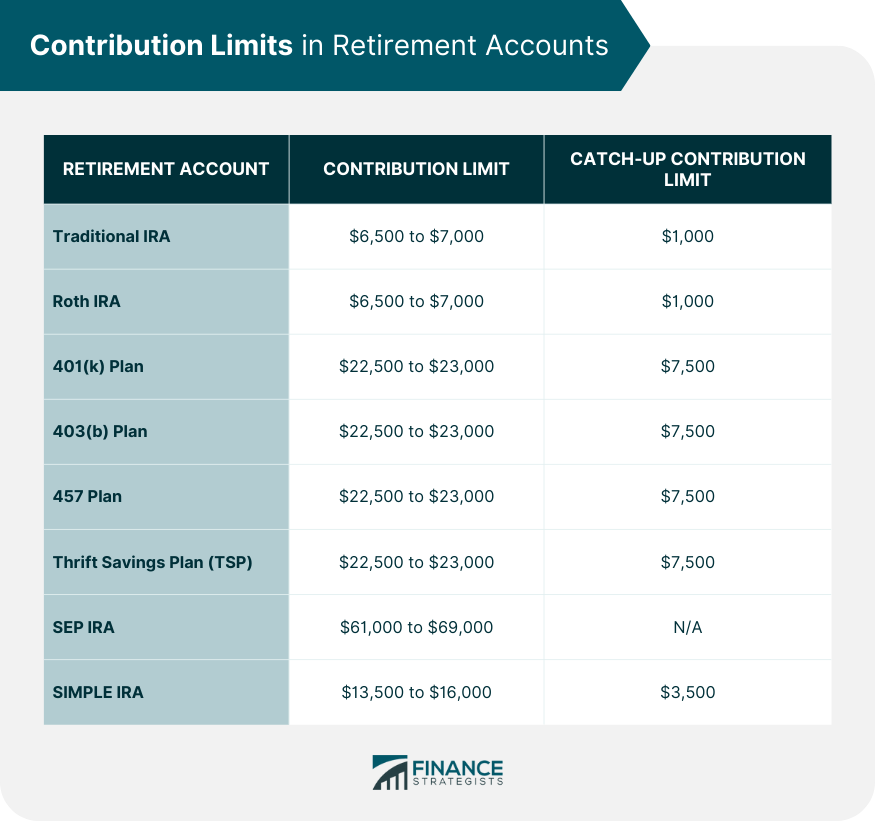

Contribution limits refer to the maximum amount of money an individual can contribute to various types of accounts, such as retirement, health savings, or education savings accounts, within a specified period, usually a calendar year. Contribution limits are established by the Internal Revenue Service (IRS) and other regulatory bodies to maintain fairness in the tax system and prevent individuals from exploiting tax-advantaged accounts to avoid taxes. Traditional IRAs are tax-deferred retirement accounts, where contributions may be tax-deductible, and withdrawals are taxed as income in retirement. The annual contribution limit for Traditional IRAs in 2024 is $7,000, with an additional $1,000 catch-up contribution allowed for individuals aged 50 or older. Roth IRAs are retirement accounts that allow for after-tax contributions, with tax-free growth and withdrawals in retirement. The annual contribution limit for Roth IRAs in 2024 is also $7,000, with an additional $1,000 catch-up contribution allowed for individuals aged 50 or older. 401(k) plans are employer-sponsored retirement accounts that allow employees to make pre-tax contributions. The annual contribution limit for 401(k) plans in 2024 is $23,000, with an additional $7,500 catch-up contribution allowed for individuals aged 50 or older. 403(b) plans are employer-sponsored retirement accounts for employees of certain tax-exempt organizations, such as schools and hospitals. The annual contribution limit for 403(b) plans in 2024 is $23,000, with an additional $7,500 catch-up contribution allowed for individuals aged 50 or older. 457 plans are nonqualified deferred compensation plans available to employees of state and local governments and some nonprofit organizations. The annual contribution limit for 457 plans in 2024 is $23,000, with an additional $7,500 catch-up contribution allowed for individuals aged 50 or older. The Thrift Savings Plan is a retirement savings plan available to federal employees and military personnel. The annual contribution limit for the TSP in 2024 is $23,000, with an additional $7,500 catch-up contribution allowed for individuals aged 50 or older. SEP and SIMPLE IRAs are retirement accounts designed for small business owners and self-employed individuals. The annual contribution limit for SEP IRAs in 2024 is the lesser of 25% of the employee's compensation or $69,000. For SIMPLE IRAs, the annual contribution limit in 2024 is $16,000, with an additional $3,500 catch-up contribution allowed for individuals aged 50 or older. The IRS regularly reviews and adjusts contribution limits for retirement accounts based on inflation and other factors. It's important to stay updated on these changes to ensure compliance and maximize contributions. Health Savings Accounts (HSAs) are tax-advantaged accounts designed to help individuals with high-deductible health plans (HDHPs) save for medical expenses. To be eligible for an HSA, an individual must be enrolled in a qualifying high-deductible health plan (HDHP) and not be covered by another non-HDHP or be enrolled in Medicare. The annual contribution limit for HSAs in 2024 is $4,150 for individuals with self-only HDHP coverage and $8,300 for those with family HDHP coverage. Individuals aged 55 or older can make additional catch-up contributions of $1,000 per year to their HSAs. There is no specific annual contribution limit for 529 college savings plans. However, contributions are subject to the federal gift tax exclusion, which is $18,000 per person per year in 2024. Each 529 plan has a lifetime contribution limit, which varies by state and plan but typically ranges up to a maximum of $550,000. Coverdell ESAs are available to individuals with a modified adjusted gross income (MAGI) below certain limits. In 2024, the phase-out range for single filers is between $95,000 and $110,000, and for joint filers, it's between $190,000 and $220,000. The annual contribution limit for Coverdell ESAs is $2,000 per beneficiary, regardless of the number of contributors or accounts. The annual limit on charitable deductions depends on the type of donation and the recipient organization. For cash donations to public charities, the limit is 60% of the donor's adjusted gross income (AGI). For non-cash donations and donations to private foundations, the limit is typically 30% of AGI. Cash donations to qualified charitable organizations are subject to the limits mentioned above, with any excess contributions eligible for a carryforward deduction for up to five years. Non-cash donations, such as property or securities, are subject to different contribution limits depending on the type of asset and recipient organization. Donor-advised funds (DAFs) are charitable giving vehicles that allow donors to make contributions and recommend grants to qualified organizations over time. Contributions to DAFs are generally subject to the same limits as cash donations to public charities. Contributing to retirement accounts can provide significant tax advantages, including tax deductions for traditional IRA contributions, tax deferral for 401(k) and other employer-sponsored plans, and tax-free growth and withdrawals for Roth IRAs. HSAs offer triple tax advantages, with contributions being tax-deductible, earnings growing tax-free, and withdrawals for qualified medical expenses being tax-free as well. Contributions to 529 plans and Coverdell ESAs grow tax-free, and withdrawals for qualified education expenses are tax-free at the federal level and often at the state level as well. Donating to qualified charitable organizations can provide tax benefits in the form of itemized deductions for contributions, reducing the donor's taxable income. Taking advantage of catch-up contributions for retirement accounts and HSAs can help older individuals save more for their future needs. Spousal contributions can help maximize retirement savings for couples, even when one spouse has little or no earned income, by contributing to a spousal IRA or increasing contributions to an employer-sponsored retirement plan. Strategically allocating contributions across various tax-advantaged accounts, such as retirement, HSA, and education savings accounts, can help optimize tax benefits and achieve financial goals. Maximizing contributions to tax-advantaged accounts can provide significant tax savings and help grow investments more quickly. Understanding and navigating contribution limits is essential for effectively managing personal finances and achieving long-term financial goals. These limits play a crucial role in financial planning, as they determine how much individuals can save and invest in various tax-advantaged accounts. Staying informed about the contribution limits and regularly adjusting one's savings strategy can help optimize tax benefits and ensure compliance with IRS regulations. To achieve long-term financial success, individuals should strategically allocate contributions across different tax-advantaged accounts, such as retirement, HSA, and education savings accounts. By utilizing catch-up contributions, spousal contributions, and balancing contributions across various accounts, individuals can optimize their savings and investments while maximizing tax advantages. Adhering to contribution limits and employing these strategies can pave the way for a more secure financial future.What Are Contribution Limits?

Contribution Limits in Retirement Accounts

Individual Retirement Accounts (IRAs)

Traditional IRA

Roth IRA

Employer-Sponsored Retirement Plans

401(k) Plans

403(b) Plans

457 Plans

Thrift Savings Plan (TSP)

Simplified Employee Pension (SEP) and Savings Incentive Match Plan for Employees (SIMPLE) IRAs

Annual Adjustments and Factors Affecting Contribution Limits

Contribution Limits in Health Savings Accounts (HSAs)

Definition and Purpose of HSAs

Eligibility Requirements

Annual Contribution Limits

Catch-up Contributions for Individuals Age 55 and Older

Contribution Limits in Education Savings Accounts

529 College Savings Plans

Annual Contribution Limits

Lifetime Contribution Limits

Coverdell Education Savings Accounts (ESAs)

Eligibility Requirements

Annual Contribution Limits

Contribution Limits in Charitable Giving

Annual Limits on Charitable Deductions

Cash Donations

Non-cash Donations

Donor-Advised Funds

Tax Implications and Benefits of Contribution Limits

Tax Advantages of Retirement Accounts

Tax Benefits of HSAs

Tax Benefits of Education Savings Accounts

Tax Benefits of Charitable Giving

Strategies for Maximizing Contributions

Taking Advantage of Catch-up Contributions

Making Spousal Contributions

Balancing Contributions Across Different Accounts

Utilizing Tax-Advantaged Accounts

Conclusion

Contribution Limits FAQs

Contribution limits are the maximum amount of money that an individual or organization can contribute to a particular type of account or plan, such as a retirement account or political campaign.

Contribution limits exist to prevent individuals or organizations from exerting too much influence or control over a particular account or plan, and to ensure that the benefits of the account or plan are distributed fairly among all participants.

Many types of accounts or plans have contribution limits, including retirement accounts such as 401(k)s and IRAs, health savings accounts (HSAs), college savings plans such as 529 plans, and political campaign contribution limits.

If you exceed the contribution limit for a particular account or plan, you may be subject to penalties or taxes. It is important to stay within the limits to avoid these consequences.

Yes, contribution limits can change over time due to various factors, such as inflation or changes in tax laws. It is important to stay up-to-date on the current contribution limits for any accounts or plans in which you participate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.