An organization can be classified as a 501(c)(3) nonprofit if it meets certain criteria outlined in section 501(c)(3) of the Internal Revenue Code and is therefore eligible for tax exemption. This status is granted by the Internal Revenue Service (IRS) to organizations that operate for charitable, religious, educational, scientific, or literary purposes. The primary goal of a 501(c)(3) organization is to serve the public good, rather than to generate profits for its members or shareholders. The importance of 501(c)(3) status is significant. It is a hallmark of legitimacy and credibility, demonstrating to potential donors, grantors, and the public that the organization has met rigorous requirements to be recognized as a charitable entity. To be eligible for 501(c)(3) status, an organization must meet certain requirements set forth by the IRS. The organization must have one or more of the following purposes: religious, charitable, educational, scientific, testing for public safety, literary, fostering national or international amateur sports competition, or preventing cruelty to children or animals. Prohibited activities include engaging in substantial lobbying activities or engaging in any activity that seeks to influence legislation or participate in any political campaign on behalf of (or in opposition to) any candidate for public office. Additionally, 501(c)(3) organizations are prohibited from participating in any activity that does not further their tax-exempt purposes or that violates public policy. 501(c)(3) organizations are also subject to a non-distribution constraint, meaning that no part of the organization's net earnings may insure to the benefit of any private individual or shareholder. This restriction is designed to prevent individuals from using a non-profit organization to enrich themselves at the expense of the organization's mission. Applying for 501(c)(3) status with the IRS is a multi-step process. The organization must first incorporate under state law and then file an application with the IRS using either Form 1023 or Form 1023-EZ. Form 1023 is the standard application for recognition of exemption and is a lengthy and detailed document. Form 1023-EZ is a shorter and simpler version of the application that is only available to smaller organizations with gross receipts of $50,000 or less and total assets of $250,000 or less. Application fees vary based on the size of the organization and the type of application being filed. The processing time for Form 1023 applications can take anywhere from several months to a year, while Form 1023-EZ applications are typically processed much more quickly. Required attachments for the application include copies of the organization's organizing documents, such as the articles of incorporation, bylaws, and any other governing documents, as well as financial statements and other supporting documentation. The IRS may also request additional information or documentation during the application process. There are several advantages to being a 501(c)(3) organization. Perhaps the most significant advantage is the tax-exempt status that comes with being a 501(c)(3) organization. This means that the organization is exempt from paying federal income taxes, as well as potential exemptions from state and local taxes. Another advantage of being a 501(c)(3) organization is that contributions made to the organization by donors are tax-deductible. This can be a significant incentive for donors, as it allows them to support charitable causes while also receiving a tax benefit. The deductibility of donations can also make it easier for organizations to secure funding from donors, as donors may be more likely to give to organizations that are recognized as tax-exempt. 501(c)(3) organizations are also eligible for grants from foundations, corporations, and government agencies. This can be a valuable source of funding for non-profit organizations, especially those that are just starting out. Additionally, being recognized as a 501(c)(3) organization can enhance the organization's credibility and reputation, as it signals to the public that the organization is dedicated to serving the public good. While there are many advantages to being a 501(c)(3) organization, there are also several disadvantages that should be considered. 501(c)(3) organizations are subject to strict rules that prohibit them from engaging in certain political activities, such as endorsing or opposing political candidates or engaging in substantial lobbying activities. This can be a significant limitation for organizations that want to advocate for specific policy positions or candidates. 501(c)(3) organizations are also subject to public disclosure requirements. This includes filing an annual tax return, Form 990, which is available to the public. Additionally, some states require organizations to file additional disclosures or reports. Donors to 501(c)(3) organizations are also subject to some disclosure requirements, as their contributions may be reported on the organization's tax return or other public filings. Another potential disadvantage of being a 501(c)(3) organization is the restriction on profit distribution. Non-profit organizations must reinvest any profits back into the organization to further its tax-exempt purposes. Founders or members of the organization cannot profit personally from the organization's activities. While this is designed to prevent abuse of the tax-exempt status, it can also limit the organization's ability to reward or incentivize key individuals. Finally, 501(c)(3) organizations are subject to a variety of administrative and regulatory requirements. This includes maintaining detailed records and books, filing annual reports with the IRS and state agencies, and complying with employment and labor laws. These requirements can be time-consuming and may require the organization to hire additional staff or professional services. Running a 501(c)(3) organization requires a comprehensive understanding of the organization's mission and goals, as well as the following components: The board of directors is responsible for overseeing the organization's operations, setting strategic goals and priorities, and ensuring that the organization is fulfilling its mission. It is important for board members to be committed to the organization's goals and to have diverse skill sets and backgrounds that can contribute to the organization's success. Additionally, the board must adhere to best practices in governance, such as maintaining accurate records, holding regular meetings, and following conflict of interest policies. Non-profit organizations must be transparent and accountable in their financial operations, which requires accurate record-keeping, timely reporting, and adherence to accounting standards. Financial management also includes creating a budget that aligns with the organization's goals and priorities, as well as ensuring that the organization has adequate financial resources to meet its needs. 501(c)(3) organizations rely on the generosity of donors to support their missions, which means that fundraising must be a priority. Effective fundraising strategies include developing a strong case for support, creating a donor recognition program, and leveraging social media and other online tools to reach potential donors. Donor relations are also essential for building a strong base of support, which requires effective communication, stewardship, and recognition of donors' contributions. Non-profit organizations must comply with a variety of regulations, including annual filing requirements, reporting of unrelated business income, and restrictions on lobbying and political activities. Failure to comply with these regulations can result in penalties, loss of tax-exempt status, and damage to the organization's reputation. It is important for non-profit organizations to have a strong compliance program in place, including regular training for staff and board members on IRS and state regulations. 501(c)(3) organizations play an important role in serving the public good and advancing important causes. However, running a 501(c)(3) organization requires a comprehensive understanding of the requirements and responsibilities that come with tax-exempt status. It is essential for non-profit organizations to prioritize governance, financial management, fundraising and donor relations, and compliance with IRS and state regulations. In order to obtain 501(c)(3) status, an organization must meet certain eligibility requirements and apply to the IRS using either Form 1023 or Form 1023-EZ. Advantages of being a 501(c)(3) organization include tax-exempt status, deductibility of donations, grant eligibility, and enhanced public perception and credibility. Disadvantages include limitations on political activities, public disclosure requirements, restrictions on profit distribution, and administrative and regulatory requirements. Running a successful 501(c)(3) organization requires strong governance, financial management, fundraising and donor relations, and compliance with IRS and state regulations. Non-profit organizations must prioritize these areas to ensure that they are fulfilling their missions and serving the public good effectively. For more information and support in filing for 501(c)(3) Organization Status, you may consult a tax services expert. What Is a 501(c)(3) Organization?

Eligibility Requirements

Purpose

Prohibited Activities

Non-Distribution of Profits

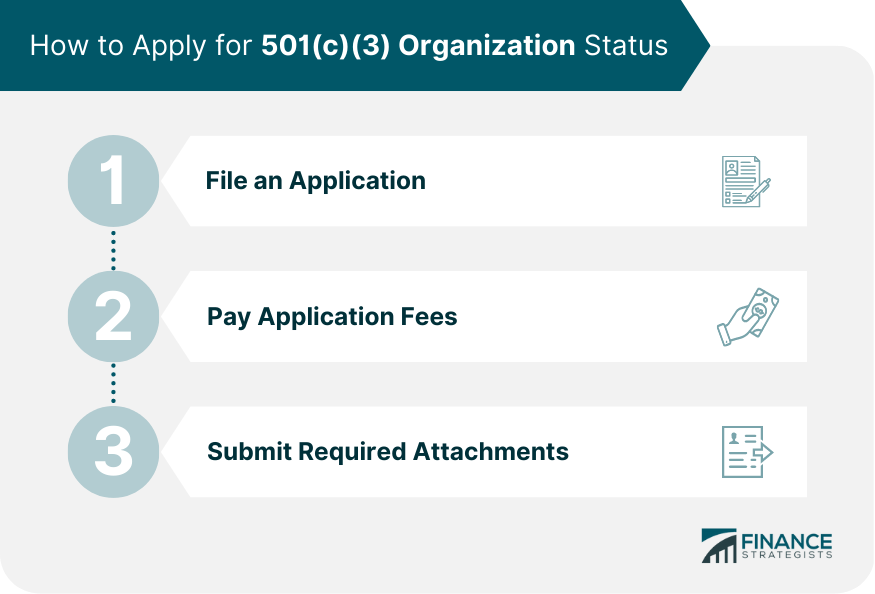

How to Apply for 501(c)(3) Organization Status

File an Application

Pay Application Fees

Submit Required Attachments

Advantages of a 501(c)(3) Organization

Tax-Exempt Status

Deductibility of Donations

Grant Eligibility

Public Perception and Credibility

Disadvantages of a 501(c)(3) Organization

Limited Political Activities

Public Disclosure Requirements

Restrictions on Profit Distribution

Administrative and Regulatory Requirements

Running a 501(c)(3) Organization

Strong Governance

Financial Management

Fundraising and Donor Relations

Compliance With IRS and State Regulations

Final Thoughts

501(c)(3) Organizations FAQs

A 501(c)(3) organization is a non-profit entity that is eligible for tax-exempt status under section 501(c)(3) of the Internal Revenue Code.

To apply for 501(c)(3) status, an organization must meet certain eligibility requirements and submit an application to the IRS using either Form 1023 or Form 1023-EZ.

Advantages of being a 501(c)(3) organization include tax-exempt status, deductibility of donations, grant eligibility, and enhanced public perception and credibility.

Disadvantages of being a 501(c)(3) organization include limitations on political activities, public disclosure requirements, restrictions on profit distribution, and administrative and regulatory requirements.

Running a successful 501(c)(3) organization requires strong governance, financial management, fundraising and donor relations, and compliance with IRS and state regulations. Non-profit organizations must prioritize these areas to fulfill their missions and serve the public effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.