The Internal Revenue Service (IRS) is a federal government agency under the U.S. Department of Treasury responsible for collecting taxes and enforcing tax laws. It was established by President Abraham Lincoln in 1862, and its headquarters is located in Washington, D.C. The primary purpose of the IRS is to collect taxes from individuals and businesses while guiding tax filing procedures and implementing tax laws. The taxes collected by the IRS helps fund programs like Social Security, Medicare, and other public benefits. The IRS also serves as an intermediary between taxpayers and the government. As such, its responsibilities include conducting audits to ensure compliance with the Internal Revenue Code (IRC) and issuing warnings or penalties for those who fail to comply. The IRS assesses taxes, collects payments, and guides taxpayers in filing their returns. It also sets tax rate schedules for individuals and businesses according to income level and administers various other taxation programs. The IRS is responsible for processing the tax returns it receives, reviewing them for deductions and credits, and issuing refunds, if applicable. It also collects revenue from trusts, estates, charities, NGOs, foundations, and foreign corporations operating within the U.S. The latest IRS data reports that in Fiscal Year (F.Y.) 2022, the agency collected $4.9 trillion in gross taxes and distributed over $641.7 billion in tax refunds. It also processed more than 262.8 million tax returns and assisted more than 58.2 million taxpayers through IRS offices. The fiscal data from the U.S. Treasury Department reports a gross revenue amounting to $4.44 trillion in F.Y. 2023. This amount is comprised of individual income taxes, corporate income taxes, medicare and social security taxes, excise taxes, estate and gift taxes, customs duties, and miscellaneous income. In 1862, President Abraham Lincoln and Congress assigned a Commissioner of Internal Revenue to levy income taxes to fund expenses during the Civil War. Income taxes were repealed and revived alternately until the Supreme Court deemed them unconstitutional in 1895. With the ratifying of the 16th Amendment in 1913, the collection of personal and corporate income taxes officially became part of the U.S. Constitution. Taxation power was vested in Congress and implemented by the Bureau of Internal Revenue. The agency was reorganized into the Internal Revenue Service in 1953. The latest comprehensive overhaul of the agency came in 1998 with the IRS Restructuring and Reform Act. Aside from revenue generation, the IRS also conducts periodic audits to ensure compliance with the Internal Revenue Code and to check the accuracy of reported information. Below are some helpful details to know about IRS Audits. The IRS selects tax returns to audit based on different factors. These include reported income significantly lower or higher than average, omissions of crucial items in the tax return, and conflicting information. You may also be examined as part of a business partner's audit. However, an audit may not automatically mean problems with your returns. The agency uses computer systems to randomly select tax returns for auditing based on statistical measurements and national averages as part of the IRS National Research Program. The IRS may request certain documents and records if you are selected for an audit. You must present all circumstances and details pertinent to the documents. Remember that you are only required to submit copies. Audit records may include the following: Receipts must be presented by date and with details of purpose and importance to your business. Bills and checks must include the payee's name, service, and payment dates. Loan agreements should detail borrower names, property locations, financial institutions, amount, payment terms, settlement sheet, interest payment details, and purpose. Employment documents may include W-2 reimbursement policies and proof of requirements like dress codes and continuing education. Legal papers relating to divorce, criminal or civil cases, property acquisition, or tax advice must provide details of the subject, date, and their relationship to your business. Medical or dental records should show reimbursements, medical savings, contracts for attendant care, etc. Tickets can provide proof of lottery earnings or losses. Travel tickets show expenses and must be prepared alongside other receipts from the same trip. Theft or loss documents can include insurance claims, fire department or police reports, photos of damages, and appraisals. The nature of the loss, theft, or damage must also be explained in these documents. Logs or diaries can provide additional information and proof of earnings or losses. You can contact the IRS by mail, phone, or online. You may also schedule an appointment at a local office and visit the agency in person. You can write or submit documents to the IRS through the postal service. The specific address depends on your purpose or business with the agency. For example, the IRS provides a list of correct addresses to submit your income tax returns based on your residence. There is also a separate list of addresses for sending non-return forms, applications, or payments. You can call the IRS toll-free at 1-800-829-1040 for personal income tax issues or 1-800-829-4933 for business tax issues, Monday through Friday, from 7:00 AM to 7:00 PM local time. Other contact numbers are available depending on the tax issue you need assistance with. The IRS developed the Interactive Tax Assistant (ITA) tool to answer your tax inquiries. The IRS website is also available 24/7 to provide information and guidance on various topics, including electronic filing, payment options, tax records, and refunds. You may visit a local IRS office if you need to ask questions or require live assistance. You can call and schedule an appointment. You should also bring documents related to your tax issues when attending an in-person meeting with the IRS. It will help you get more accurate and faster results from the agency and its officers. You can pay your taxes in full or in installments through the following payment methods: The EFW is an integrated system for electronic filing and payment. It is a convenient and safe way of paying individual or business taxes. This payment method is only available for taxpayers who are using tax preparation software or through a tax professional. The EFW system allows you to submit multiple payment requests and direct debit from your chosen bank account. This service is for paying individual taxes. You can pay straight from your checking or savings account. To start, you simply specify the reason for payment and select the appropriate form and tax period. The direct pay service is free and available Mondays to Saturdays from 12:00 MN to 11:45 PM and Sundays from 7:00 AM to 11:45 PM Eastern Time. Taxpayers are limited to two transactions within 24 hours and a maximum of $10 million in payment amounts. Taxpayers can pay their taxes using a credit or debit card. The payment processor charges a fee for this service which varies based on the type of card and the amount being paid. This method is available depending on your tax professional or preparation software. Additionally, some software allows partial and deferred payments if you file the tax forms first. You can also go the traditional route and pay cash through various IRS retail partners around the US. Fees are charged based on the retail partner. You can pay up to $500 per transaction with no daily limit on the number of payments. Remember that you would still select the tax form and the associated year online. It is only the actual payment that will be in person. The IRS may allow you to set up an installment agreement if you cannot pay your taxes in full. Here you can negotiate a payment plan that works best for you. An interest rate may apply depending on how much is being paid and the duration of the payment plan. Set-up fees are also charged, which range from $31 to $225. The installment option is subject to approval by the IRS. The IRS is a bureau of the Department of Treasury charged with administering the nation's tax laws. The primary mission of the IRS is to collect taxes for federal programs, enforce policies, and ensure that citizens comply with the U.S. tax code. The agency also conducts audits to verify that taxpayers accurately report their income and other applicable information. There are various reasons behind the audit selection, including omissions of crucial items in the tax return and conflicting information. When dealing with the IRS during audits, it is best to have complete documents on hand. It is also an excellent idea to lessen the chances of being selected for an audit by paying taxes on time. This strategy is made easy because the IRS offers a variety of payment methods taxpayers can avail of. For any concerns, taxpayers can contact the IRS online, by phone, through the mail, or in person for inquiries and guidance about filings, refunds, and other tax services.What Is the Internal Revenue Service (IRS)?

How the IRS Works

History of the IRS

IRS Audits

Reasons for Audit Selection

Required Records

How to Communicate With the IRS

By Mail

By Phone

Online

In Person

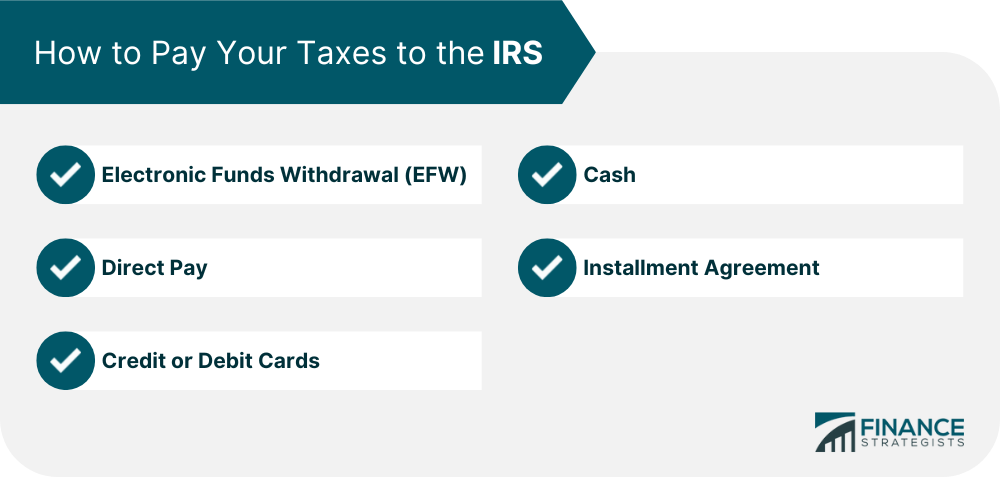

How to Pay Your Taxes to the IRS

Electronic Funds Withdrawal (EFW)

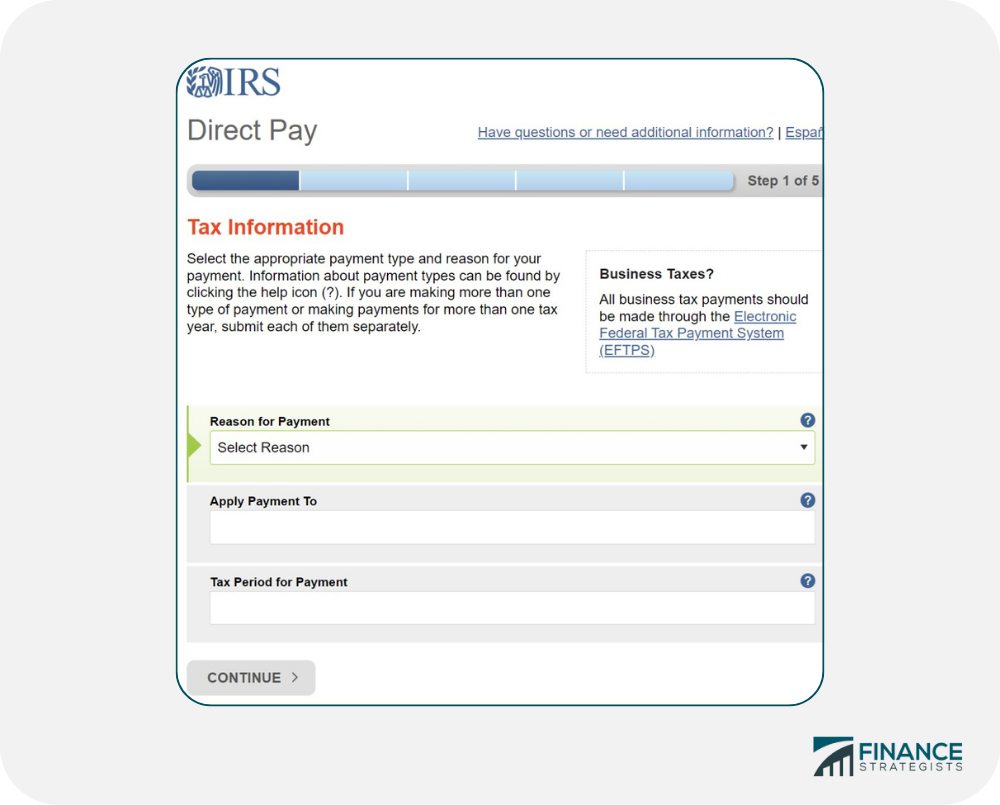

Direct Pay

Credit or Debit Cards

Cash

Installment Agreement

Final Thoughts

Internal Revenue Service (IRS) FAQs

If you do not pay the IRS on time, they will assess penalties and interest on your unpaid balance. Depending on the length of time outstanding and the amount owed, your delinquent tax debt may be subject to collection action, such as a bank levy or wage garnishment. The IRS also reserves the right to file criminal charges in cases of demonstrable intent to evade taxes.

The IRS typically contacts taxpayers through a series of letters. The initial letter is usually a Notice of Deficiency, which informs the taxpayer of an issue and requests payment or other action to resolve it.

When the IRS sends you a letter, it is important to read and understand the contents. Depending on the type of letter you receive, you may need to provide additional information or documentation to resolve an issue. In some cases, the IRS might require payment or other action to complete the processing of your tax return. It is best to respond promptly to IRS communications to avoid potential penalties or negative consequences.

The IRS typically investigates taxpayers for up to three years if the taxpayer does not file a return or up to six years for an overstated deduction or omission of income. However, if the taxpayer has committed fraud or evaded taxes, there is no time limit, and the IRS can investigate as far back as necessary.

The IRS is constantly monitoring and cross-checking taxpayer data. As such, it may detect discrepancies between reported income and other forms of documentation, such as bank statements or investment accounts. The IRS may also compare your tax return to those filed by third parties, such as employers or lenders.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.