A capital gain is a financial benefit from selling a capital asset over its adjusted basis. A capital asset is something you own and use for personal or investment purposes. A home, personal-use assets such as domestic furnishings, and stocks or bonds held as investments are all examples. Adjusted basis is the cost basis of an asset adjusted for different events during its ownership.

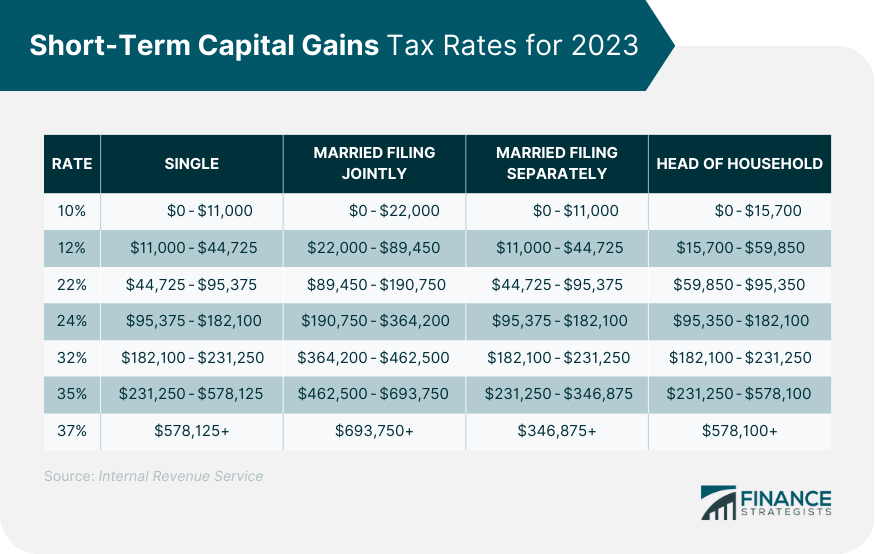

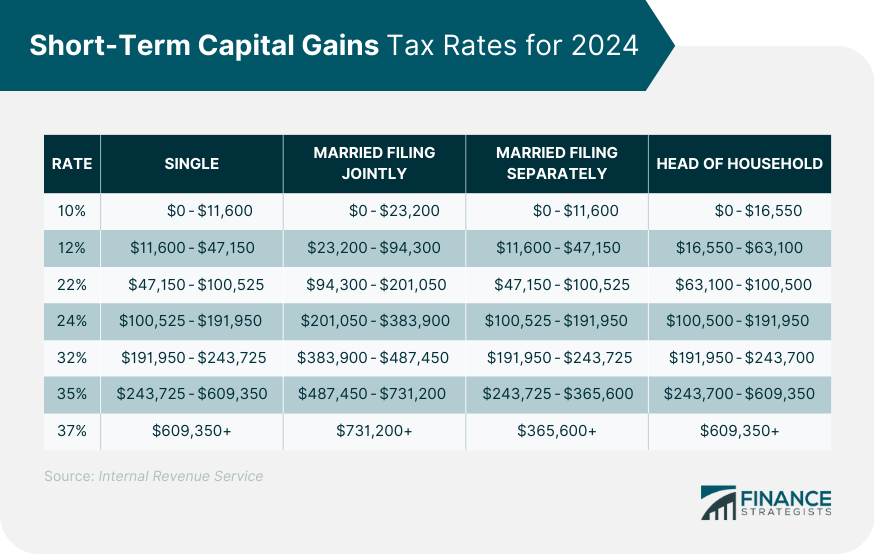

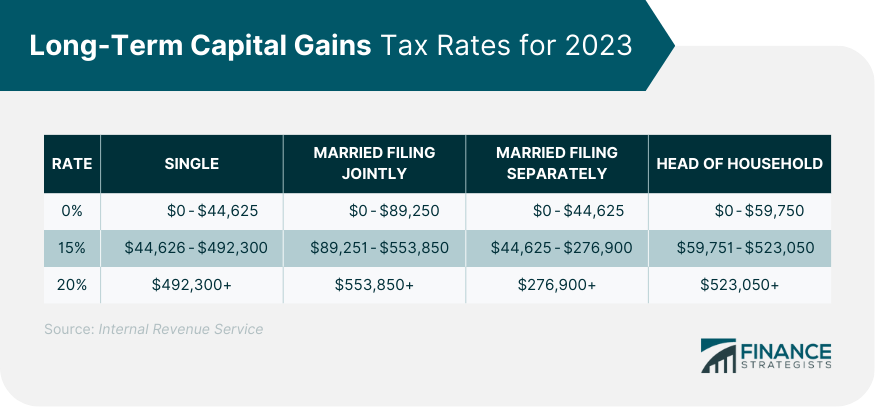

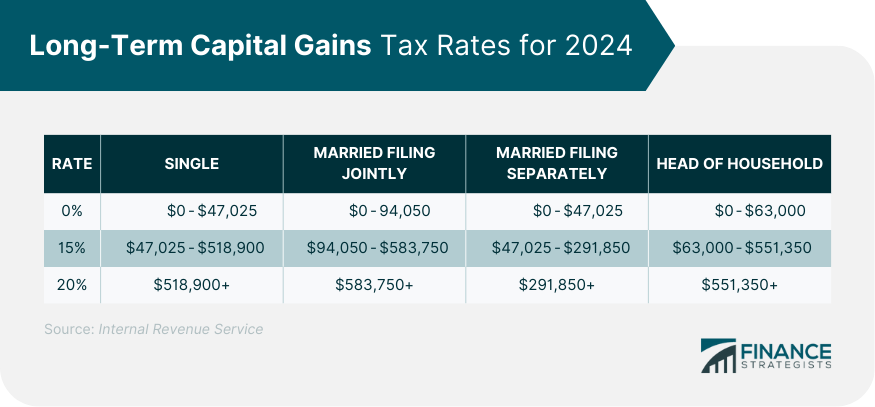

A short-term capital gain happens when an asset is sold for a profit after being owned for one year or less. If you buy a stock for $100,000 and sell it two months later for $150,000, you have made a short-term capital gain of $50,000. Your marginal tax rate is the income tax you pay on each additional dollar you earn. It calculates how much taxes will be due when your income jumps from one level to another, such as going above the standard deduction or personal exemption. For most taxpayers, this is the same as their ordinary income tax rate. The exact tax rate depends on your tax bracket. Long-term capital gains are profits from the sale of an asset held for more than a year. For example, if you buy a stock for $ 285,000 and sell it for $350,000 after holding it for two years, you have made a $65,000 long-term capital gain. Generally, the tax rate applied to long-term capital gains is lower than that on short-term gains. Investments made in the short term are taxed at your standard income rate. Currently, there are 7 income tax brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The income cut-offs and capital gains tax brackets are shown in the table below: The long-term capital gains tax rates are 0%, 15%, and 20%. The ordinary income tax rate, which applies to short-term capital gains, is often significantly higher than these. There are several key differences between short and long-term capital gains. The first significant difference is the holding period required to qualify for each type of gain. Short-term capital gains apply to assets held for one year or less. However, when an asset is kept for more than a year, the owner is eligible for long-term capital gains. The other key difference is the type of asset that will generate the gain. Short-term capital gains are generated from any capital asset, including stocks, bonds, mutual funds, and real estate investments. Long-term capital gains are only associated with assets that meet specific criteria, such as stocks and certain types of real estate investments with a 1 to 3 years holding period. Short-term capital losses can offset short-term capital gains for tax purposes. If you have net short-term losses in a given year, you will not have to pay taxes on short-term gains from other investments. However, long-term capital losses can only offset long-term capital gains and not short-term gains. The tax rate on short-term capital gains is the same as your regular income tax, while long-term rates have a unique tax bracket. Knowing the tax rates for each type of gain is also essential, as it can help you plan for when and how much you will owe in taxes in any given year. It is always recommended that you consult a financial advisor if you have questions about how these rules apply to your particular situation. In addition to the standard tax rates for capital gains, certain exceptions, and special rates apply in certain situations. The gain from selling Qualified Small Business Stock (QSBS) can be excluded from taxable income under Section 1202 of the Internal Revenue Code. The amount exempt from capital gains tax is the greater of $10 million or ten times the stockholder's adjusted basis, which is typically the purchase price. Any excess gain is subject to a maximum tax rate of 28%. Gains on collectibles, including art, antiques, jewelry, precious metals, and stamp collections, are taxed at 28%, regardless of your income. You will be subject to this increased tax rate even if your tax bracket is below 28%. Your capital gains taxes will be at most the 28% rate even if you are in a tax band with a higher rate. Suppose you sold your primary residence and realized a capital gain. In that case, you can exclude up to $250,000 of that gain from your income. For joint filing with a spouse, you can exclude up to $500,000. In general, you must pass both the ownership and use tests to be eligible for the exclusion. Suppose you have owned and utilized your home as your primary residence for a cumulative total of at least two out of the five years before the date of sale. In that case, you are eligible for the exception. Real estate investors are frequently permitted to subtract depreciation from their profits to account for the property's gradual decline over time. The depreciation deduction decreases the amount you are deemed to have initially paid for the property. If you sell the property, your taxable capital gain may rise. That is because there will be a more significant discrepancy between the property's valuation after deductions and its sale price. High-income earners are subject to the net investment income tax. This 3.8% tax applies to individuals with an adjusted gross income of more than $200,000 for singles and $250,000 for married couples filing jointly. Some exclusions are qualified dividends, capital gains from mutual fund investments, and capital gains from selling real estate investments held for more than one year. Understanding all aspects of capital gains taxation is essential to minimize tax liability. The capital gains tax essentially decreases the entire profit on the investment. However, there is a legal means through which certain investors can lower or even get their net capital gains taxes for the year eliminated. The holding period for an investment determines whether any profit or gain from the asset's sale is taxed as a short-term or long-term gain. Investments held for more than a year are eligible for the lower capital gains tax rate and are therefore classified as long-term investments. Suppose you invest in stocks, bonds, mutual funds, and other assets over an extended period. In that case, you can benefit from the lower long-term capital gains tax rates. It results in significant tax savings. The 401(k) and IRA retirement plans offer a great way to lower capital gains taxes. These accounts are tax-deferred, meaning any earnings or profits from investments made within these accounts remain sheltered until you take distributions at retirement. Investors can defer the taxation of their capital gains until later when they may be in a lower tax bracket. Investors can also use losses on investments to offset future taxable gains through a process known as carryover or netting against losses. This strategy allows investors to reduce their current year's taxable gains by carrying over any net losses to the following year. Using capital losses to offset capital gains in a given tax year allows investors to reduce their overall taxable gain and, consequently, their tax liability. Investors need to accurately track each investment's cost basis, as this will help to ensure that they correctly calculate and report any gains or losses on the investments. Capital gains are profits from selling an asset - such as a stock, bond, or piece of real estate that has increased in value. Short-term capital gains are profits from the sale of an asset that you have owned for one year or less. Long-term capital gains are profits from the sale of an asset that you have owned for more than one year. Capital gains are taxed based on asset ownership and tax bracket. The amount of capital gains you pay is based on your tax bracket, which is determined by your filing status. Special rates apply to capital gains in certain situations, such as the gain from selling QSB stocks, collectibles, and home sale exclusion. To reduce the taxes, you pay for your capital gains; you could observe holding periods, invest long-term, and utilize tax-deferred retirement plans. You could also net against your losses and use your capital losses to offset the gains. Accurately tracking your investment’s cost basis also helps in reducing your taxes. When it comes to capital gains, there is a big difference between short-term and long-term. Short-term capital gains can be an option if you are looking for quick profits. Long-term capital gains may be better if you aim for long-term growth.Short-Term vs Long-Term Capital Gains: Definition

Short-Term Capital Gains

Long-Term Capital Gains

Short-Term Capital Gains Tax Rates

Long-Term Capital Gains Tax Rates

Short-Term vs. Long-Term Capital Gains: Key Differences

Holding Period

Capital Asset

Offsetting Losses

Tax Rate

Capital Gains Special Rates and Exceptions

Qualified Small Business (QSB) Stock

Collectibles

Home Sale Exclusion

Real Estate Investment

Investment Exceptions

Strategies to Reduce Capital Gains Taxes

Observe Holding Periods

Invest Long-Term

Utilize Tax-Deferred Retirement Plans

Carry Over Loss to the Next Year

Utilize Capital Losses to Offset Gains

Determine Cost Basis

Final Thoughts

Short-Term vs Long-Term Capital Gains FAQs

Short-term capital gains are profits from selling an asset you have owned for less than a year. Conversely, long-term capital gains refer to earnings made on investments held longer than one year.

The IRS tracks capital gains through Form 1099-B and Form 8949, which are used to report profits and losses resulting from the sale of investments. It is essential for investors to accurately track and determine their cost basis to ensure that they are correctly calculating and reporting any gains or losses on the investments.

Some strategies to reduce capital gains taxes include observing holding periods, investing long-term, utilizing tax-deferred retirement plans, carrying over losses to the following year, utilizing capital losses to offset gains, and determining cost basis.

No, long-term capital gains rates did not increase in 2024. The Tax Cuts and Jobs Act of 2017 kept long-term capital gains rates the same. The long-term capital gains rate remains at 0%, 15%, or 20%, but the salary bracket changed. The capital gains rate still depends on the taxpayer's income level, though.

Certain capital gains may be exempt from taxation. Qualified Small Business (QSB) Stock, collectibles, home sale exclusions, and real estate investments are some assets that may be eligible for notable exceptions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.