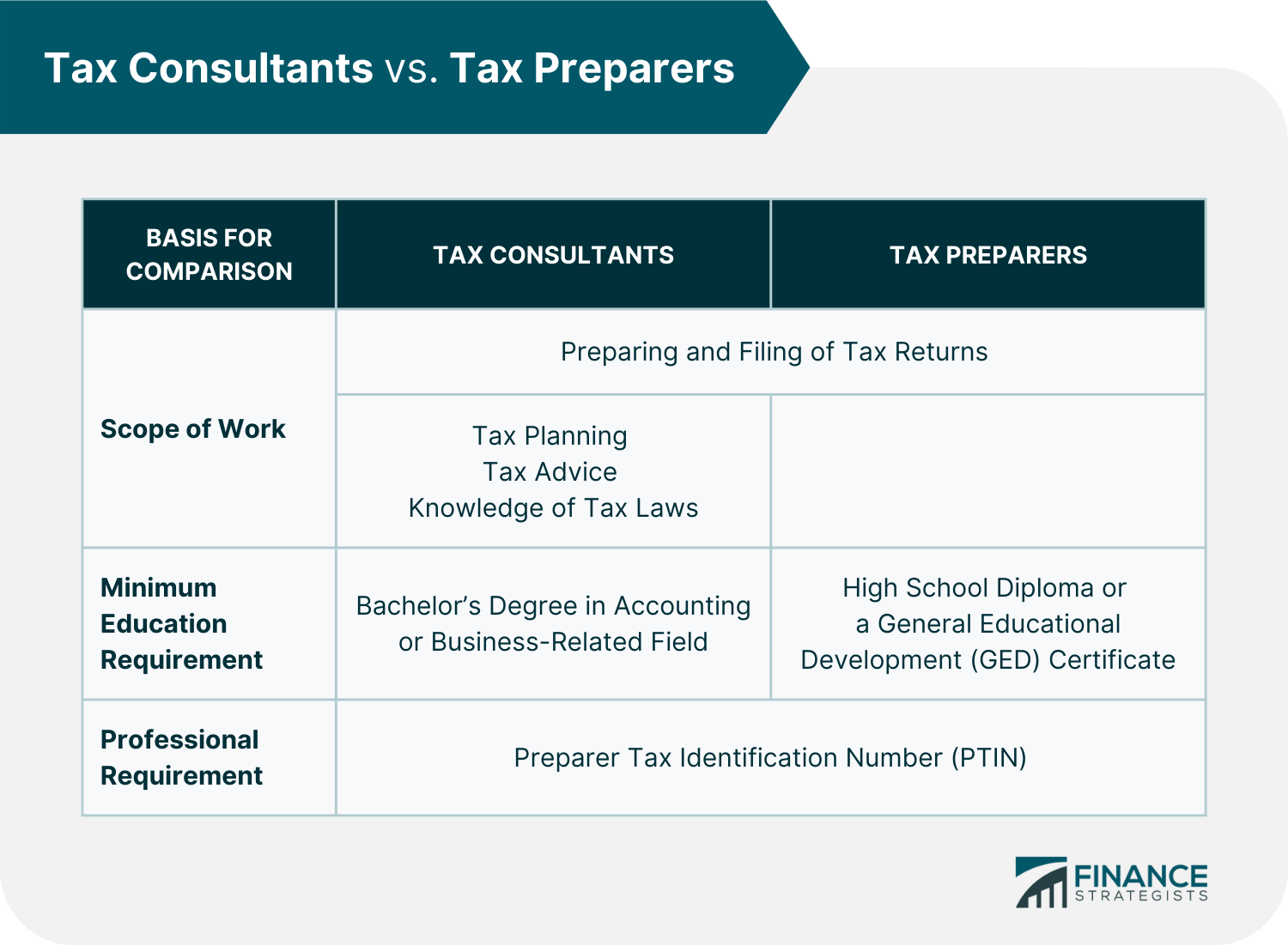

A tax consultant is a professional who gives comprehensive and strategic advice on tax-related matters. They work with individuals and organizations to minimize potential tax liability and ensure compliance with tax laws. To qualify for a tax consultant position, individuals must undergo the minimum required education in a business, tax, or finance-related field. They might also need to acquire specific certifications and apply for a special license from the Internal Revenue Service (IRS). This role is often a good fit for detail-oriented, analytical individuals who enjoy working with numbers or those with good financial skills who enjoy assisting others. Many businesses engage tax consultants to help with tax matters. These include accounting firms, law firms, banks, and real estate companies. Some tax consultants also choose self-employment. The standard duties and responsibilities of tax consultants include the following: CPAs hold a prestigious accounting designation requiring rigorous education, experience, and passing a national exam. They offer a broad range of financial services, including tax preparation, tax planning, and tax advice. CPAs are well-suited for individuals and businesses with complex financial situations. Enrolled Agents are federally licensed tax practitioners specializing in tax law. They can represent taxpayers before the IRS and have in-depth knowledge of the tax code. EAs are a good option for individuals with intricate tax situations or those needing help resolving IRS issues. ATAs are tax professionals who have earned a designation from the Accreditation Council for Accountancy and Taxation (ACAT) by meeting stringent requirements. This includes education, experience (with a focus on tax planning and consulting), and passing a comprehensive exam. ATAs possess in-depth knowledge of federal, state, and local tax laws. They can provide a wide range of tax services, including complex tax planning for individuals and businesses, estate planning, and representation during IRS audits. Tax attorneys are lawyers specializing in tax law. While they can prepare tax returns, their primary focus is on complex tax issues, international tax matters, and tax litigation. If you're facing an IRS audit or have a highly specialized tax situation, a tax attorney may be the best choice. Individuals need to possess specific qualifications to become tax consultants. Below is a list of these requirements: Tax consultants generally have bachelor's degrees in accounting, finance, business administration, business tax, or other related fields. A master's degree is optional but advantageous as it deepens exposure to complex tax issues. Graduate programs in taxation, accounting, business administration, and legal studies are good options. Certifications enhance the skills and knowledge of tax professionals. This also opens up further opportunities and enables them to provide additional services to their clients. Enrolled Agent (EA): This certification is the highest credential issued by the IRS. It is earned by passing a comprehensive exam or through experience as an IRS employee. Seventy-two hours of continuing education courses every three years is also a requirement. Accredited Tax Advisor (ATA): The ATA certification is issued by The Accreditation Council for Accountancy and Taxation. Three years of experience in tax preparation, planning, compliance, and consulting are needed before one can take the certification exam. There is also a continuing education requirement of 30 hours per year or 90 hours within three years. Certified Public Accountant (CPA): Tax consultants who are also CPAs have added credibility. CPAs have a bachelor’s degree in accounting or a related field. Then they must pass the exam administered by the American Institute of Certified Public Accountants (AICPA). Annual Filing Season Program: This voluntary IRS program is for seasonal tax professionals who want to add to their skills and knowledge. Those who complete 18 hours of continuing education and pass a tax law test receive a record of completion. Whatever designations they hold, the tax consultants who prepare tax returns for individuals must have a Preparer Tax Identification Number (PTIN) issued by the IRS. This is the primary license needed by a financial professional to process tax returns with the IRS. The skills needed to be an effective tax consultant are the following: Accounting Skills Tax consultants assess clients' financial records, so accounting skills are essential in identifying critical information, verifying its accuracy, and performing necessary calculations. Ability to Do Financial Analysis Tax consultants need the skills to analyze tax returns and other financial statements because this will be their basis for suggesting improvements that could reduce their clients' tax obligations. Knowledge of Tax Law It is essential to know about tax laws and their business application. This knowledge helps ensure compliance during the tax preparation process. Attention to Detail The ability to thoroughly process even the most minor information is instrumental in tax consulting. This allows the tax consultant to assess the overall financial situation with accuracy. Communication Skills Good verbal and written communication skills enable tax consultants to share and receive information with clarity and precision. This makes way for effective consultation and case discussions. Organization Skills An organized physical and digital filing system makes it easy to locate documents when needed. This skill can be beneficial for tax consultants who are handling multiple clients. Ability to Do Research Tax consultants also need to have the ability to explore and research tax law and regulation. This ability ensures that the tax consultant is updated with current changes and can provide their clients with the most appropriate tax advice. Tax consultation fees depend on various factors, including location and the complexity of services rendered. Here are a few ways in which tax consultants charge their fees: Tax consultants can have a range of specialties, so selecting one best suits your needs is crucial. Here are some pointers to consider: Tax Consultants vs. Tax Preparers A Tax Preparer is a professional who focuses primarily on preparing and filing income tax forms. To become a tax preparer, individuals must possess a high school diploma or a General Educational Development (GED) Certificate. In contrast, tax consultants need at least a Bachelor’s Degree in Accounting or a Business-related Field. Like tax preparers, tax consultants also prepare and file income tax returns. However, tax consultants are more knowledgeable about tax law and can offer additional services such as tax planning or tax advice. While expertise varies among individual tax consultants, generally, they may be able to help clients with a broader and more complex array of financial and taxation concerns compared to tax preparers. Both tax consultants and tax preparers must register with the IRS and obtain a Preparer Tax Identification Number, which will serve as a license to prepare and file tax returns. Tax consultants are experts who give strategic advice on tax-related matters. They support both businesses and individuals in complying with tax laws and regulations. They also offer other services, such as tax planning and audit representation. Although some clients choose a tax preparer over a tax consultant, clients who need more comprehensive advice or have complicated tax situations could benefit more from working personally with a tax consultant. If you decide to hire a tax consultant, you must first verify if they possess the right qualifications in terms of educational background, credentials, licenses, skills, and related experience. For example, most tax consultants have a PTIN issued by the IRS, but only some will specialize in handling clients within the same industry as your business. Therefore it is crucial to ask for recommendations or choose candidates from reliable sources and narrow them down by interviewing the best ones. Then, before signing any contracts, you should also ask your prospects questions about their fees and how they structure their services so that you can make a more informed decision. Choosing a tax consultant might need a bit of investment in terms of time. However, once the right candidate has been selected, you can rest assured that your tax consultant will look out for your best interest in tax-related matters.What Is a Tax Consultant?

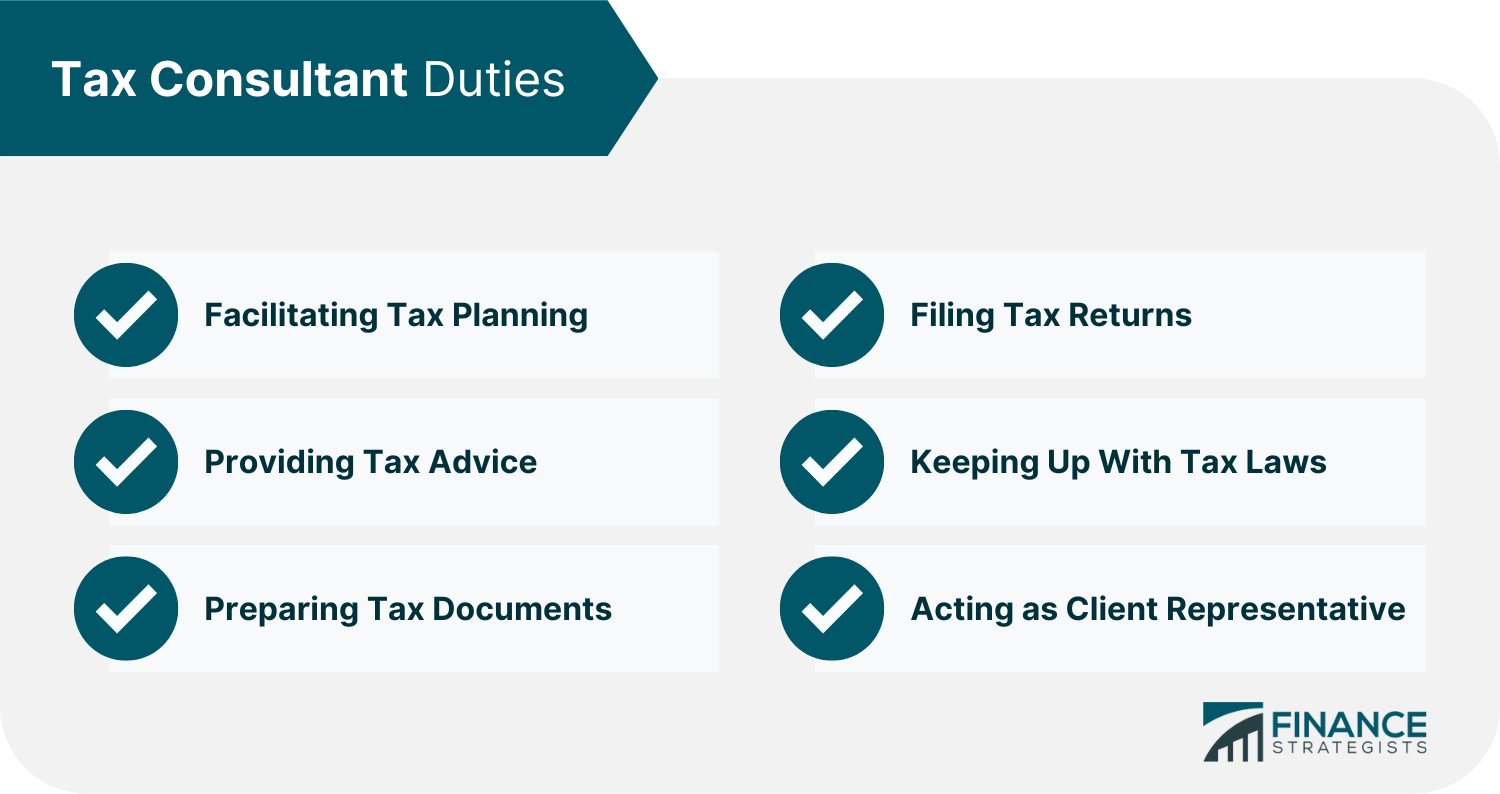

Duties of a Tax Consultant

Types of Tax Consultants

Certified Public Accountants (CPAs)

Enrolled Agents (EAs)

Accredited Tax Advisors (ATAs)

Tax Attorneys

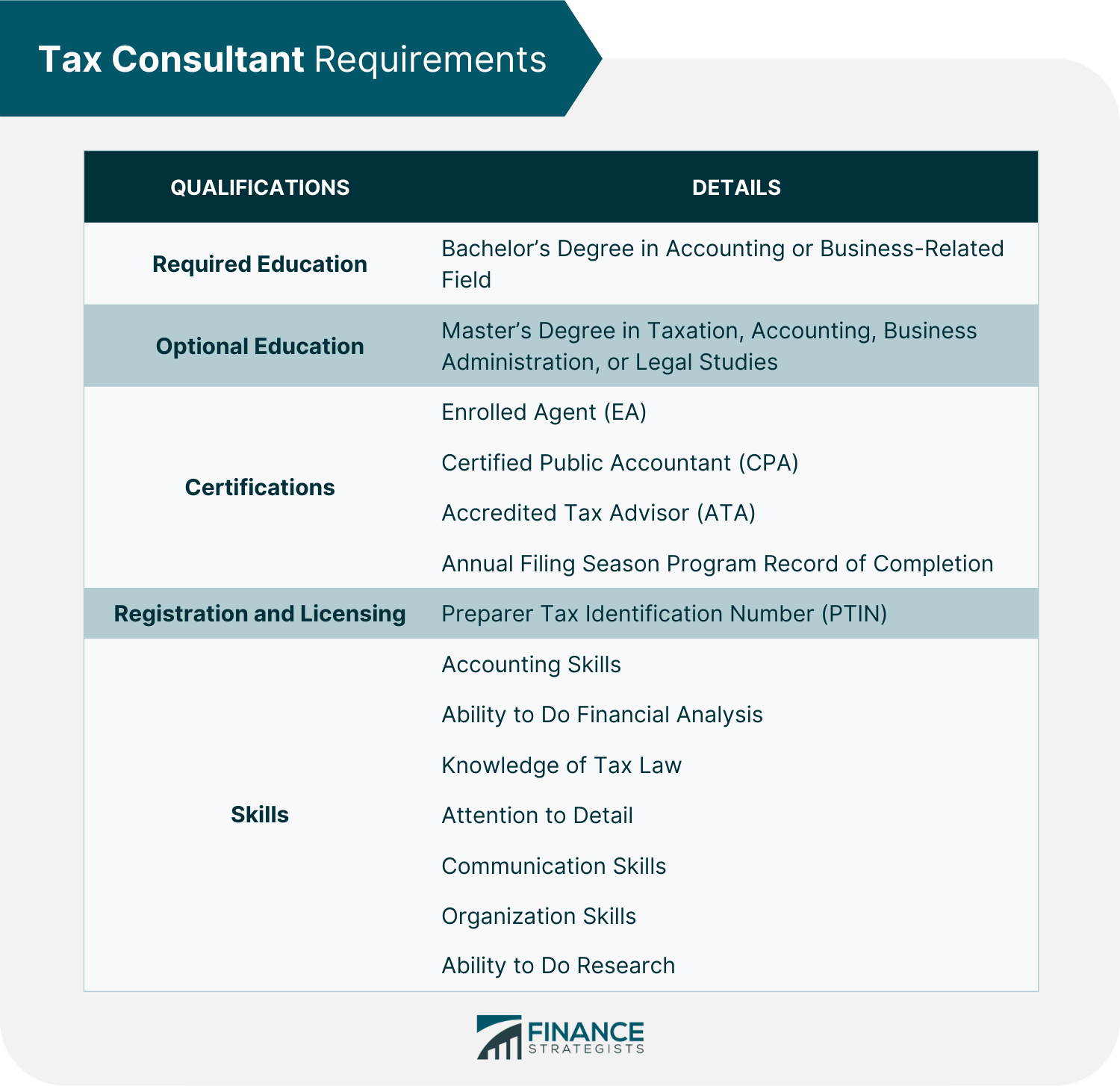

Requirements to Become a Tax Consultant

Education

Certification

Registration and Licensing

Skills

Cost of Hiring a Tax Consultant

Custom consulting may cost approximately $2,000 or more per year. With this setup, the client and tax consultant can thoroughly discuss the business records and assess the situation more deeply.

Tax consultants may bill only standard filing fees if their client does not receive monetary compensation from the opposing party.

How to Find a Tax Consultant

Final Thoughts

Tax Consultants FAQs

A tax consultant provides tax-related advice, prepares and files tax returns for individuals and organizations, and ensures that clients are tax-compliant.

A tax consultant provides tax-related advice, while an accountant helps businesses make critical financial decisions by collecting, tracking, and correcting company finances.

A tax consultant is responsible for facilitating tax planning, providing tax advice, preparing tax returns, keeping up with tax laws, and acting as a client representative during audits.

A career in tax consulting is considered a stable path. Tax professionals are always needed by businesses and individual taxpayers, regardless of economic conditions.

A bachelor's degree in an accounting or business-related field is needed to become a tax consultant. Many consultants also get professional endorsements like the certified public accountant (CPA) or accredited tax advisor (ATA) designation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.